Use the following to answer question:

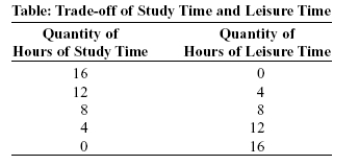

-(Table: Trade-off of Study Time and Leisure Time) Use Table: Trade-off of Study Time and Leisure Time.A student sleeps 8 hours per day and divides the remaining time between study and leisure time.The table shows the combinations of study and leisure time that can be produced in the 16 waking hours of each day.Suppose this student is studying 4 hours and spending 10 hours doing leisure activities.This point is:

Definitions:

High Deductible Health Plan

A High Deductible Health Plan (HDHP) is a health insurance plan with lower premiums and higher deductibles than a traditional health plan, often linked to Health Savings Accounts (HSAs).

Health Savings Account

An account that allows individuals with high-deductible health plans to save money tax-free for medical expenses.

Out-Of-Pocket Expenses

Costs that an individual must pay out of their own cash reserves, including medical expenses, business expenses not reimbursed, and other personal expenditures.

Self-Employed Health Insurance

A deduction that allows self-employed individuals to deduct 100% of their health insurance premiums from their taxable income.

Q25: In the market for canned pinto beans,

Q29: A family from Peru eats in a

Q38: (Figure: Rent Controls) Use Figure: Rent Controls.

Q72: (Figure: Production Possibilities and Circular-Flow Diagram) Use

Q76: A maximum price legislated by the government

Q89: Which statement is a positive economic statement?<br>A)

Q107: All points on the production possibility frontier

Q192: (Table: International Transactions) Refer to Table: International

Q246: If a country has a current account

Q307: Coworkers Yvonne and Rodney are washing dishes