Use the following to answer questions:

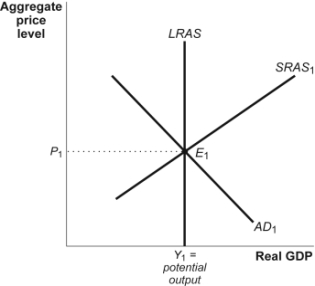

Figure: AD-AS Model II

-(Figure: AD-AS Model II) Refer to Figure: AD-AS Model II. If there is a significant increase in government spending, in the short run the _____ curve will shift to the _____.

Definitions:

Long-term Capital Gain

Profit from the sale of an asset held for more than one year, typically taxed at a lower rate than regular income.

Section 1245

A section of the tax code that involves recapturing depreciation on certain types of property as ordinary income upon sale.

Section 1231 Gain

A gain from the sale or exchange of property used in a business, subject to favorable tax treatment under Section 1231 of the U.S. tax code.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Q17: In a simple, closed economy (no government

Q21: Contractionary fiscal policy shifts the aggregate demand

Q26: Which asset is part of M1?<br>A) long-term

Q79: If your disposable personal income increases from

Q92: If real GDP is smaller than planned

Q111: When planned investment is less than actual

Q118: An increase in the interest rate causes

Q164: An increase in the price of oil

Q179: If the SRAS curve intersects the aggregate

Q302: The short-run aggregate supply curve will shift