Use the following to answer questions:

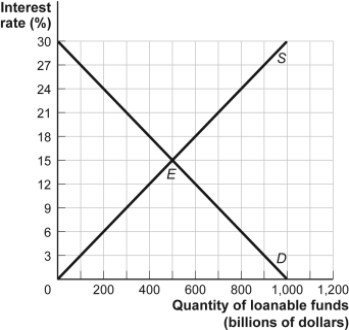

-(Figure: The Market for Loanable Funds III) Use Figure: The Market for Loanable Funds III. If the government in a closed economy finances deficits by selling bonds and it decides to decrease defense spending by $200 billion, the equilibrium interest rate will:

Definitions:

Future Value

The value of an investment at a specified date in the future, considering factors like interest rates and time.

Present Value

The contemporary valuation of a future quantity of money or cash flow series, assuming a specific interest rate.

Annuity Due

A type of annuity payment where the payment is due at the beginning of each period, rather than at the end.

Expected Cash Flows

The projected amounts of money to be received or paid out by a business within a specified period.

Q7: A patient at the crisis intervention clinic

Q17: A newly admitted patient tells the nurse,

Q39: (Figure: Aggregate Supply Movements) Refer to Figure:

Q59: The planned aggregate spending line has a

Q70: A decrease in the demand for loanable

Q93: An inflationary gap gradually:<br>A) increases short-run aggregate

Q159: Which asset is the LEAST liquid?<br>A) a

Q181: Suppose that the economy is in long-run

Q318: A relatively low saving rate affects productivity

Q348: Compared with individual loans, loan-backed securities provide