The sequencer load instruction shown:

Definitions:

Excise Tax

Excise tax is a tax on the sale or use of specific products or transactions, often levied to discourage certain behaviors or raise revenue.

Shifted

The movement of a supply or demand curve in a market due to changes in factors such as consumer preferences, production costs, or number of suppliers.

Corporate Income Tax

A tax imposed on the net income of a corporation that is derived from its business activities.

Shift

A change in the position of the supply curve or demand curve in a market, indicating a change in market conditions.

Q1: Full-duplex transmission allows the transmission of data

Q7: The procedure of pre-start-up inspection is commonly

Q8: For the programmed timer circuit shown, when

Q11: Power to the processor module is controlled

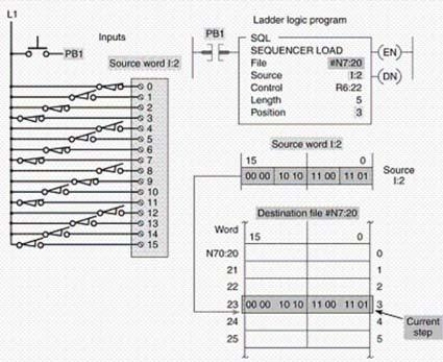

Q29: For the program shown, what is the

Q44: The main advantage to the jump-to-label instruction

Q44: Which of the following pieces of information

Q58: A PID loop is normally tested by

Q65: Proper grounding procedures for a PLC installation

Q86: Ladder logic is a symbolic language.