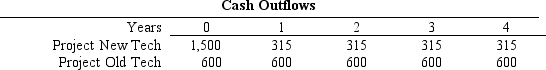

Alabama Pulp Company (APC) can control its environmental pollution using either "Project Old Tech" or "Project New Tech." Both will do the job, but the actual costs involved with Project New Tech, which uses unproved, new state-of-the-art technology, could be much higher than the expected cost levels.The cash outflows associated with Project Old Tech, which uses standard proven technology, are less risky they are about as uncertain as the cash flows associated with an average project.APC's required rate of return for average risk projects normally is set at 12 percent, and the company adds 3 percent for high risk projects but subtracts 3 percent for low risk projects.The two projects in question meet the criteria for high and average risk, but the financial manager is concerned about applying the normal rule to such cost-only projects.You must decide which project to recommend, and you should recommend the one with the lower PV of costs.What is the PV of costs of the better project? a. 2,521

a. 2,521

b. 2,399

c. 2,457

d. 2,543

e. 2,422

Definitions:

Q1: If two bonds have the same maturity

Q3: The stand-alone risk is the risk an

Q18: Empirical studies of risk strongly support the

Q26: Mesmer Analytic, a biotechnology firm, floated an

Q34: The firm's weighted average cost of capital

Q40: In cash flow estimation, the presence of

Q45: If the expected rate of return on

Q73: Tax adjustments to the cost of preferred

Q90: The main reason that the NPV method

Q169: A firm that only utilizes 40% of