Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

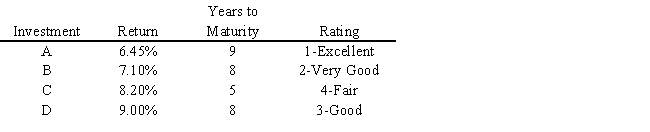

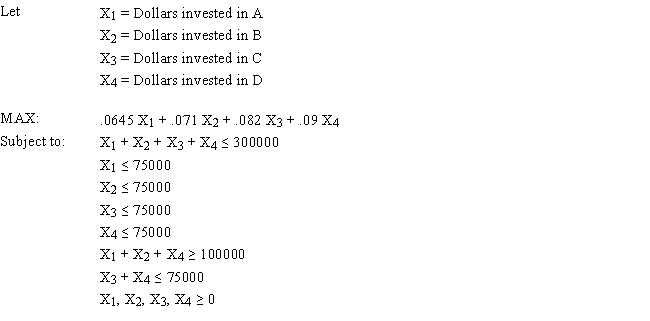

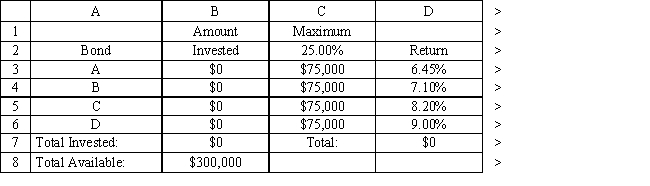

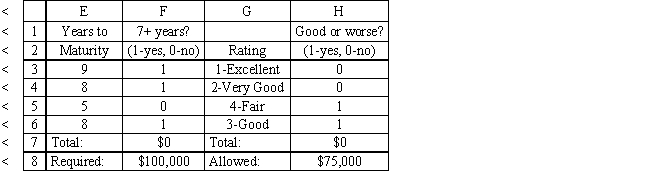

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return?

Definitions:

Q26: According to Mary Parker Follett .<br>A) most

Q32: Upper-level managers may actually spend more time

Q52: The "Objective Sense" option in the Risk

Q64: Consider the following linear programming model

Q66: The number of constraints in network flow

Q73: The creation of Ingram Distribution allows booksellers

Q74: The English-reading eye scans<br>A) Right to left<br>B)

Q110: Companies look for a total of four

Q112: Two homebuilders are building homes in nearby

Q126: According to a speech to a forum