The following questions correspond to the problem below and associated Risk Solver Platform (RSP) sensitivity report.

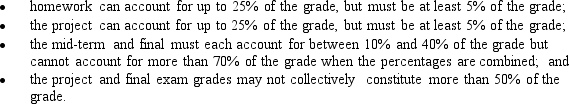

Robert Hope received a welcome surprise in this management science class; the instructor has decided to let each person define the percentage contribution to their grade for each of the graded instruments used in the class. These instruments were: homework, an individual project, a mid-term exam, and a final exam. Robert's grades on these instruments were 75, 94, 85, and 92, respectively. However, the instructor complicated Robert's task somewhat by adding the following stipulations:

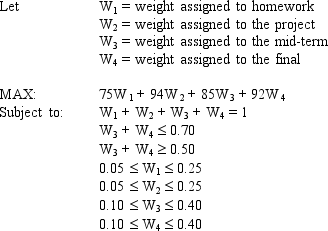

The following LP model allows Robert to maximize his numerical grade.

The following LP model allows Robert to maximize his numerical grade.

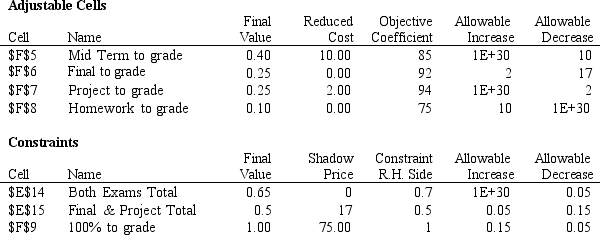

-Refer to Exhibit 4.2. Based on the Risk Solver Platform (RSP) sensitivity report information, is there anything Robert can request of his instructor to improve his final grade?

Definitions:

Receivables Balance

The total amount owed to a business by its customers or clients for goods or services delivered on credit.

Allowance Method

An accounting technique used to estimate and account for doubtful accounts, where some receivables will not be collected.

Uncollectible Accounts

Financial accounts receivable that are deemed unlikely to be collected, leading to their categorization as bad debts.

Year-end Adjustment

Adjustments made to the books of accounts at the end of a fiscal year to reflect accurate financial information.

Q9: The RHS value of a goal constraint

Q13: A company needs to supply customers

Q20: Refer to Exhibit 7.1. Which cells are

Q38: If a company produces Product 1,

Q39: Refer to Exhibit 11.7. What are

Q39: One approach to solving integer programming problems

Q44: Refer to Exhibit 11.8. What formula should

Q56: The symbols X<sub>1</sub>, Z<sub>1</sub>, Dog are all

Q62: Draw the network representation of the

Q65: A company is developing its weekly