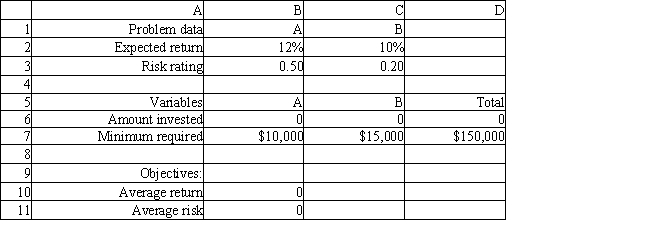

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. Which cell(s) is(are) the target cells in this model?

Definitions:

Economic Profits

The surplus remaining after deducting all costs, including opportunity costs, from total revenues, indicating a firm's financial performance beyond breaking even.

Decreasing Returns to Scale

A situation in which, as the scale of production increases, the output increases at a diminishing rate, resulting in reduced efficiency.

Price-Inelastic

Describes a situation where the quantity demanded or supplied changes little when the price changes.

Prisoner's Dilemma

A scenario in game theory where two individuals acting in their own self-interest do not produce the optimal outcome.

Q2: Refer to Exhibit 11.6. What formula should

Q10: Refer to Exhibit 11.6. What formula should

Q17: R<sup>2</sup> is calculated as<br>A) ESS/TSS<br>B) 1 <font

Q19: Given an objective function value of 150

Q20: Refer to Exhibit 11.18. What formulas should

Q33: Refer to Exhibit 10.2. What is the

Q40: Models which are setup in an intuitively

Q50: If using the regression tool for two-group

Q51: Refer to Exhibit 11.19. What are the

Q68: The number of arrivals to a store