Exhibit 8.2

The following questions pertain to the problem and spreadsheet below.

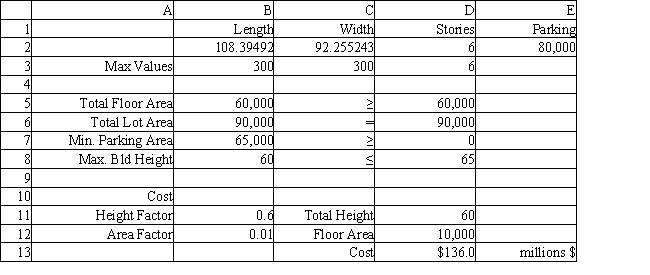

A construction company just purchased a 300 × 300 foot lot upon which they plan to build an office building. They need at least 60,000 ft2 of office floor space. Zoning regulations require each floor be 10 feet high and the building not exceed 65 ft in height. Further, parking space must equal at least 30% of the total floor space available. The company's cost accountant uses a 60% factor of the building height and a 1% factor of any story's floor area to calculate the total building cost (in millions of dollars).

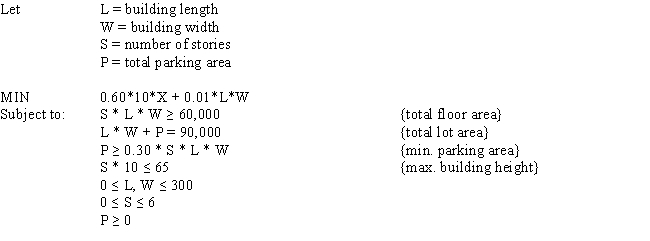

The following is the NLP formulation for the problem.  The spreadsheet implementation of this formulation applies to the following questions.

The spreadsheet implementation of this formulation applies to the following questions.

-Refer to Exhibit 8.2. What formula would you place into cell B5 to calculate Total Floor Area?

Definitions:

Average Tax Rate

The portion of total income that is paid as taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Taxable Income

The portion of an individual's or entity's income that is subject to taxation by governmental authority after deducting allowable deductions.

Lump-Sum Tax

A tax that is of a fixed amount and does not vary with the taxpayer’s income level or asset value.

Consumption Tax

A levy imposed on the acquisition of goods and services, charged at the time of purchase.

Q7: For a minimization problem, if a decision

Q18: A company needs to ship 100

Q20: Residuals are assumed to be<br>A) dependent, uniformly

Q21: An oil company wants to create lube

Q26: Solve the following LP problem graphically

Q26: An investor wants to invest $50,000

Q37: Benefits of sensitivity analysis include all the

Q44: Refer to Exhibit 7.4. The solution indicates

Q45: Refer to Exhibit 13.3. What is the

Q53: The difference between the right-hand side (RHS)