Exhibit 10.7

The information below is used for the following questions.

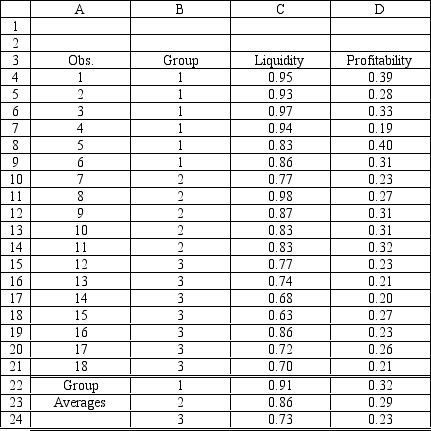

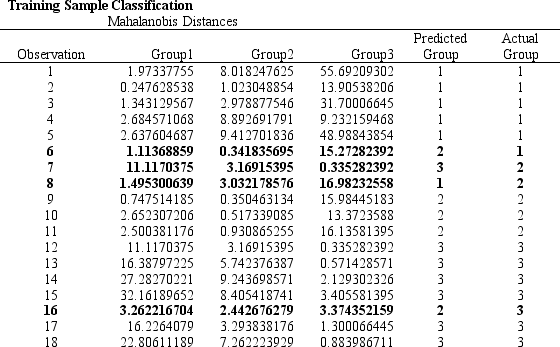

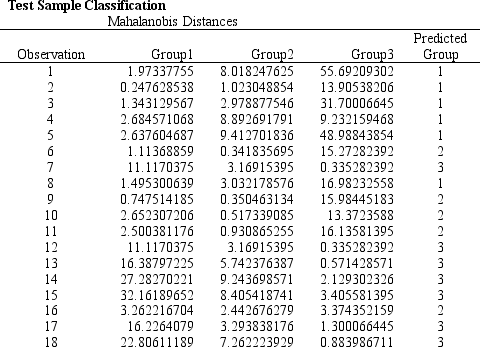

An investor wants to classify companies as being a High Risk Investment, Group 1, a Medium Risk Investment, Group 2, or a Low Risk Investment, Group 3. He has gathered Liquidity, Profitability data on 18 companies he has invested in and produced the following spreadsheet. The following Discriminant Analysis output using Risk Solver Platform (RSP) has also been generated.

-Refer to Exhibit 10.7. Based on the 18 observations in the model complete the following confusion/classification matrix.

Definitions:

Employers

Individuals or organizations that hire workers to perform specific jobs in exchange for compensation.

Trait Anxiety

A personality characteristic that denotes an individual's tendency to perceive a wide range of situations as threatening and respond with anxiety.

Manage Anxiety

Techniques or strategies employed to control feelings of worry and nervousness.

Procedures

Step-by-step instructions designed to perform a specific task or solve a particular problem.

Q10: Refer to Exhibit 11.6. What formula should

Q15: Refer to Exhibit 15.6. Modify the

Q22: What method is used to generate observations

Q24: Refer to Exhibit 8.1. What formula is

Q34: Refer to Exhibit 9.7. What is the

Q41: The standardized queuing system notation such as

Q46: Refer to Exhibit 14.9. What formula should

Q67: A company wants to determine the optimal

Q74: Refer to Exhibit 9.4. Based on the

Q75: Why might a forecaster calculate MSE values