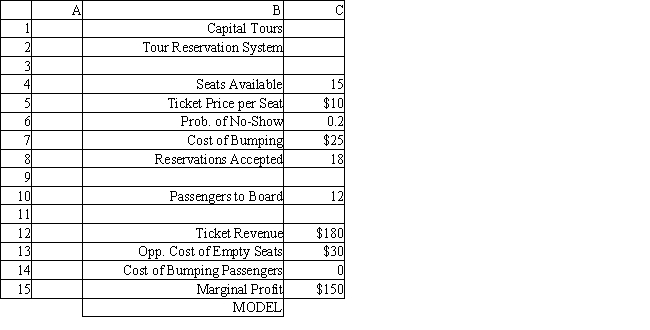

Exhibit 12.4.

The following questions use the information below.

The manager of a Washington, DC sightseeing tour company is concerned about overbooking for one of his bus tours. The bus has 15 seats but sometimes there are empty seats. His records show that about 20% of ticket holders do not show up for their tour. Tickets cost $10 and are non-refundable. If the manager overbooks the tour and more than 15 passengers show up, some of them will be bumped to a later tour. This bumping costs the company $25 in various expenses to keep the customer happy until the next tour. The manager wants to see what happens to profits if 18 reservations are accepted.

-Using the information in Exhibit 12.4, what formula should go in cell C14 of the worksheet to determine the Cost of Bumping Passengers?

Definitions:

Long-Term Creditors

Entities or individuals to whom a company owes money, with the obligation for repayment extending beyond one year.

Debt To Total Assets Ratio

A financial metric indicating the proportion of a company's total assets that are financed by debt.

Times Interest Earned Ratio

A financial metric that compares a company's operating income to its interest expenses, used to evaluate its ability to meet its interest obligations.

Q1: When delays occur owing to technical difficulties,

Q18: In the design of an inventory system

Q20: All of the following are forecasting models,

Q22: The Delphi method is best used when

Q24: Refer to Exhibit 9.1. What is the

Q26: Refer to Exhibit 14.14. What formula is

Q33: Refer to Exhibit 14.9. The original payoff

Q36: Refer to Exhibit 15.4. The following

Q56: The researcher would like to build a

Q66: An investor is considering 2 investments, A,