A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, 2013, at a selling price of $885,295, to yield the buyers a 12% return. The company uses the effective interest amortization method. Interest is paid semiannually each June 30 and December 31.

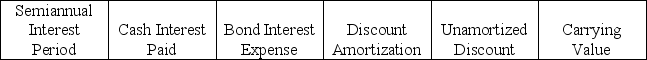

(1) Prepare an amortization table for the first two payment periods using the format shown below:

(2) Prepare the journal entry to record the first semiannual interest payment.

(2) Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Average Total Costs

The cost per unit of output, calculated by dividing the total cost by the quantity of output produced.

Technological Change

The process of innovation and development of new methods, products, or processes, driving efficiency and economic growth.

Fixed Costs

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance, making them consistent regardless of business activity levels.

Short Run

A period of time in which at least one input, such as plant size, is fixed and cannot be changed by the firm, limiting its capacity to adjust output levels.

Q9: The times interest earned ratio is a

Q19: Which one of the following is representative

Q32: A cash-based measure that is used to

Q41: Use the following information to calculate the

Q44: The total depreciation expense over an asset's

Q95: Describe the journal entries required to record

Q95: Obligations due to be paid within one

Q112: The formula for computing annual straight-line depreciation

Q143: Many companies use accelerated depreciation in computing

Q195: A _ is a written promise to