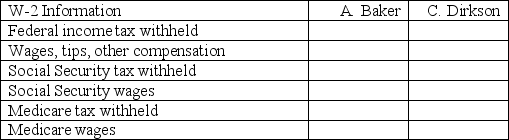

A company's employer payroll taxes are 0.8% for federal unemployment taxes, 5.4% for state unemployment taxes, 6.2% for FICA Social Security taxes on earnings up to $106,800 and 1.45% for FICA Medicare taxes on all earnings. Compute the W-2 Wage and Tax Statement information required below for the following employees:

Definitions:

Actual Threats

Genuine risks or dangers that are present and could cause harm.

"Old-Fashioned" Discrimination

Discrimination practices or attitudes that are rooted in historical or traditional biases and inequalities, often based on race, gender, or social class.

Modern Discrimination

Refers to current forms and practices of unfair treatment or prejudice against individuals or groups based on race, gender, age, or other characteristics, often subtle and institutionalized.

Defensive Discrimination

Practices or attitudes that emerge as a defensive mechanism, often based on prejudice or bias, intended to protect a group from perceived threats.

Q21: A payee of a note will always

Q29: A maker who dishonors a note is

Q37: A contingent liability is a potential obligation

Q52: A company issued 10%, five-year bonds

Q62: The full disclosure principle requires the reporting

Q74: The journal entry to record distribution of

Q84: Calculate the total amount of interest that

Q135: Installment accounts receivable is another name for

Q179: The current FUTA tax rate is 0.8%

Q181: On April 1, 2013, a company disposed