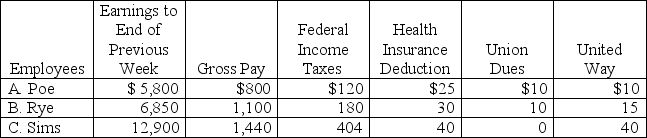

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Lymphatic System

A vital part of the immune system, consisting of organs, ducts, and nodes that transport lymph, a fluid containing infection-fighting white blood cells, throughout the body.

Lymphocytes

A type of white blood cell involved in the immune response, playing a role in protecting the body against infections and diseases.

Macrophages

A type of white blood cell that engulfs and digests cellular debris, foreign substances, microbes, and cancer cells in a process called phagocytosis.

Lingual Tonsils

Small masses of lymphatic tissue located at the base of the tongue, important for immune response against inhaled or ingested pathogens.

Q22: On September 1, 2010, Drill Far Company

Q71: A company had net sales of $230,000

Q72: Payroll taxes are considered to be contingent

Q125: A company purchased equipment on July

Q152: The _ principle requires that companies report

Q156: Which of the following procedures would weaken

Q171: The payroll records of a company provided

Q176: Identify and explain the different types and

Q177: Classify each of the following items

Q186: A corporation borrowed $125,000 cash by