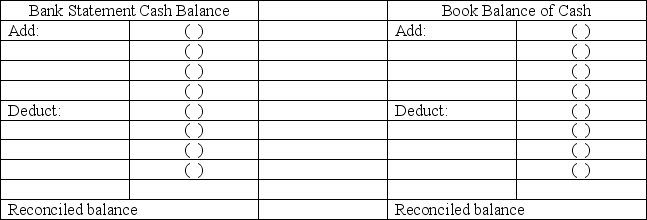

Following are seven items (a) through (g) that would cause Xavier Company's book balance of cash to differ from its bank statement balance of cash.

a. A service charge imposed by the bank.

b. A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c. A customer's check returned by the bank is marked "Not Sufficient Funds. (NSF)"

d. A deposit that was mailed to the bank on the last day of the current month and is unrecorded on this month's bank statement.

e. A check paid by the bank at its correct $190 amount was recorded in error in the company's Check Register at $109.

f. An unrecorded credit memorandum indicated that bank had collected a note receivable for Xavier Company and deposited the proceeds in the company's account.

g. A check was written in the current period that is not yet paid or returned by the bank.

Indicate where each item (a) through (g) would appear on Xavier Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Definitions:

Carl Rogers

An influential American psychologist who founded the humanistic approach to psychology, emphasizing the importance of the self and the individual's capacity for personal growth.

Rational-Emotive Theory

A cognitive-behavioral approach to therapy that emphasizes the role of thinking and belief systems as the root of emotional and behavioral disturbances.

Animalistic Drives

Fundamental, instinctual forces that motivate behavior, often related to survival and reproduction.

Psychoanalytic Theories

A set of theories originating from Sigmund Freud that emphasize unconscious motivations and conflicts as driving human behavior and psychological development.

Q52: A company purchased a machine for $970,000.

Q103: _ are amounts owed by customers from

Q105: The bank statement included a check from

Q128: Hasbro had net sales of $7,875 and

Q137: A company purchased a machine on January

Q138: What does FOB stand for? Differentiate between

Q165: The FIFO inventory method assumes that costs

Q183: A company purchased a leasehold property for

Q186: A company had sales of $375,000 and

Q194: The entry to record reimbursement of the