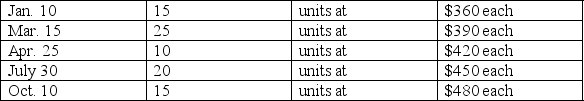

A company made the following purchases during the year:

On December 31, there were 28 units in ending inventory. These 28 units consisted of 1 from the January 10 purchase, 2 from the March 15 purchase, 5 from the April 25 purchase, 15 from the July 30 purchase, and 5 from the October 10 purchase. Using specific identification, calculate the cost of the ending inventory.

On December 31, there were 28 units in ending inventory. These 28 units consisted of 1 from the January 10 purchase, 2 from the March 15 purchase, 5 from the April 25 purchase, 15 from the July 30 purchase, and 5 from the October 10 purchase. Using specific identification, calculate the cost of the ending inventory.

Definitions:

Percentage Depletion

A tax deduction method that allows an owner or operator of a mine or other natural resources to deduct a percentage of the resource's value as it is depleted.

Asset/Liability Method

An approach in accounting where income taxes are adjusted based on the differences between the financial reporting and tax bases of assets and liabilities.

Interperiod Tax Allocation

The process of apportioning income tax expenses between different accounting periods to match tax expense with the revenue that generated the tax.

Intraperiod Tax Allocation

The process of allocating income taxes within a single financial reporting period among different items that directly affect reported net income or loss.

Q11: A company markets a climbing kit and

Q15: A single-step income statement includes cost of

Q17: The aging method of determining bad debts

Q38: Expenses incurred but unpaid that are recorded

Q78: A company plans to decrease a $200

Q100: LIFO is the preferred inventory costing method

Q154: Evaluate each inventory error separately and

Q170: Merchandise inventory is reported in the long-term

Q180: The approach to preparing financial statements based

Q213: Which of the following statements regarding financial