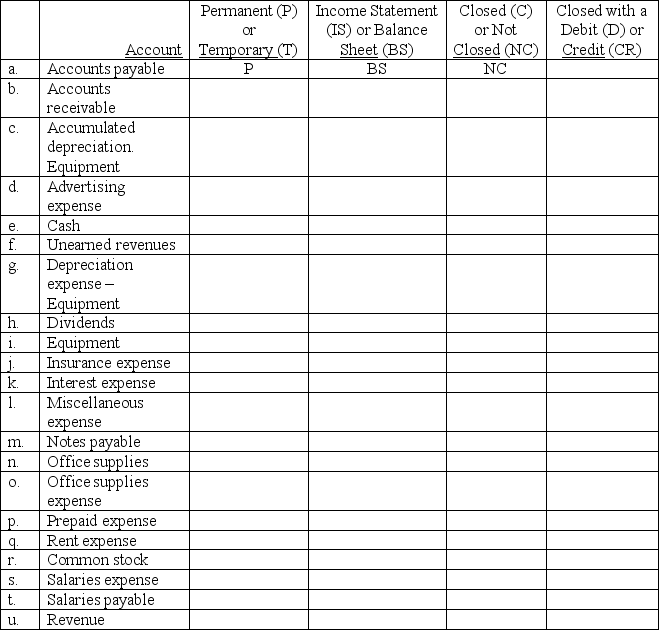

Listed below are a number of accounts. Use the table below to classify each account. Indicate whether it is a temporary or permanent account, whether it is included in the income statement or balance sheet, and if it is closed at the end of the accounting period and, if so, how it is closed. The first one is done as an example.

Definitions:

State Taxes

Taxes imposed by state governments on income, sales, property, and other activities within their jurisdiction.

Federal Government

The national government of a federated state, which shares sovereignty with the individual state or provincial governments.

Property Tax

A tax on the value of property, such as the value of a home.

Personal Taxes

Taxes levied on the income or property of individuals.

Q31: A post-closing trial balance includes:<br>A) All ledger

Q48: The inventory valuation method that identifies the

Q92: The gross margin ratio is defined as

Q109: Recording the items on the financial statements

Q112: The International Accounting Standards Board (IASB) has

Q155: Beta Corporation purchased $100,000 worth of land

Q181: A service company earns net income by

Q185: A buyer did not take advantage of

Q189: If the _ is responsible for paying

Q194: A trial balance that balances is not