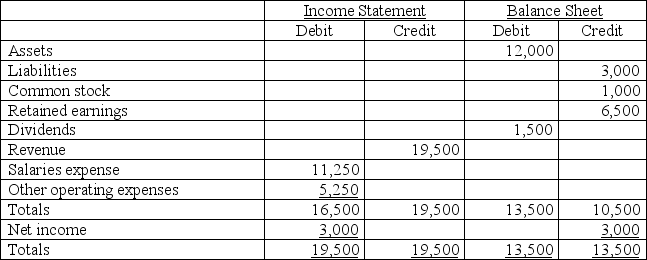

The summary amounts below appear in the Income Statement and Balance Sheet columns of a company's December 31 work sheet. Prepare the necessary closing entries.

Definitions:

Home Equity Indebtedness

Debt secured by a qualified residence that exceeds the acquisition indebtedness, with interest on such debt often being deductible under U.S. tax law.

Acquisition Indebtedness

Debt incurred in acquiring, constructing, or substantially improving a qualified residence of the taxpayer, and secured by the residence.

Qualified Residence Interest

Interest paid on a mortgage for a primary or secondary residence, which can be deductible for taxpayers who itemize deductions.

Deductibility

The extent to which an expense can be subtracted from gross income to reduce taxable income and lower the tax liability.

Q9: A company's warehouse was destroyed by a

Q65: Internal users of accounting information include lenders,

Q79: Fill in the blanks (a) through (g)

Q147: Cool Tours had beginning equity of $72,000,

Q148: If the assets of a business increased

Q158: A debit memorandum is:<br>A) Required whenever a

Q208: A company had total equity of

Q213: What would be the appropriate entry for

Q217: The first five steps in the accounting

Q234: The records of Skymaster Airplane Rentals show