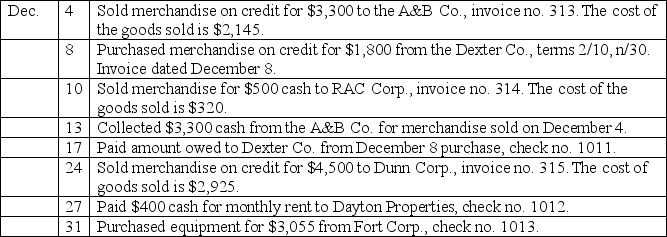

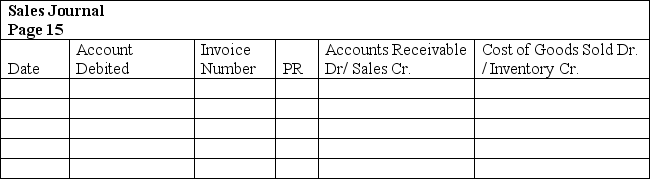

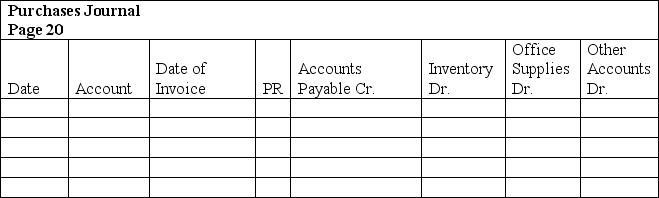

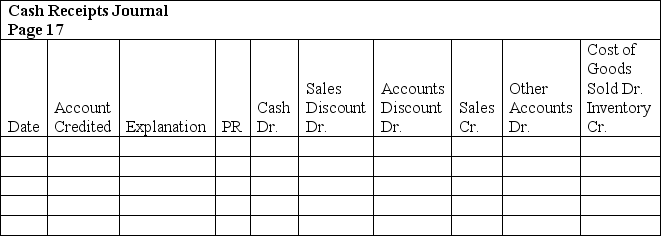

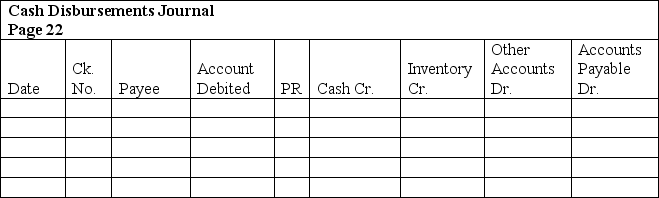

The Woodview Company uses a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and general journal. They use the perpetual method. The following transactions occurred during the current month of December:

Record the above transactions into the appropriate journals shown below:

Record the above transactions into the appropriate journals shown below:

Definitions:

Libraries

Collections of books, digital resources, and other media, housed in either virtual or physical spaces, for research, study, or leisure.

Sponsorship

Financial or material support provided to events, activities, or individuals, often for promotional benefits.

Website

A collection of related web pages, including multimedia content, typically identified with a common domain name, and published on at least one web server.

Validity

The extent to which a concept, conclusion, or measurement is well-founded and corresponds accurately to the real world.

Q1: Salary allowances are reported as salaries expense

Q13: Holden, Phillips, and Rogers are partners with

Q14: The _ principle requires that an accounting

Q14: Kathleen Reilly and Ann Wolf decide to

Q15: Ending liabilities are 67,000, beginning equity was

Q34: A partnership is an unincorporated association of

Q41: Jimmy Hayes is a partner in Sports

Q85: The _ principle requires that an accounting

Q208: A company had total equity of

Q213: The accountant of Magic Video Games