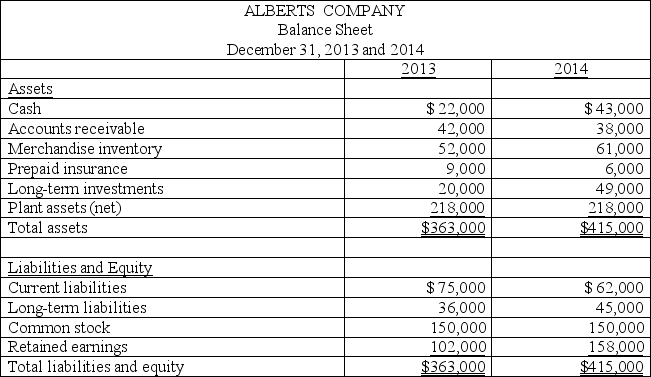

Express the following balance sheets for Alberts Company in common-size percents.

Definitions:

External Financing

This refers to funds raised from outside the company, including loans, credit, or investments from external entities, to support the company's activities.

Capital Structure

The mix of debt, equity, and other financing methods used by a company to fund its operations and growth.

After-Tax Cost

After-tax cost refers to the expense of a transaction or investment after accounting for the effects of taxes, providing a clearer picture of the true financial impact.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment or project, calculated as the difference between the present value of cash inflows and outflows.

Q4: Paco and Kate invested $99,000 and $126,000,

Q50: The optimal usage fee to charge is

Q56: What is the estimated marginal revenue function

Q59: If partners devote their time and services

Q63: Which strategy for punishing cheating has consistently

Q63: Which of the following financial statement sections

Q70: If the firm is producing 300 units

Q125: Long-term investments are reported in the:<br>A) Current

Q136: Sanuk purchased on credit £20,000 worth of

Q175: A company's balance sheet and income statement