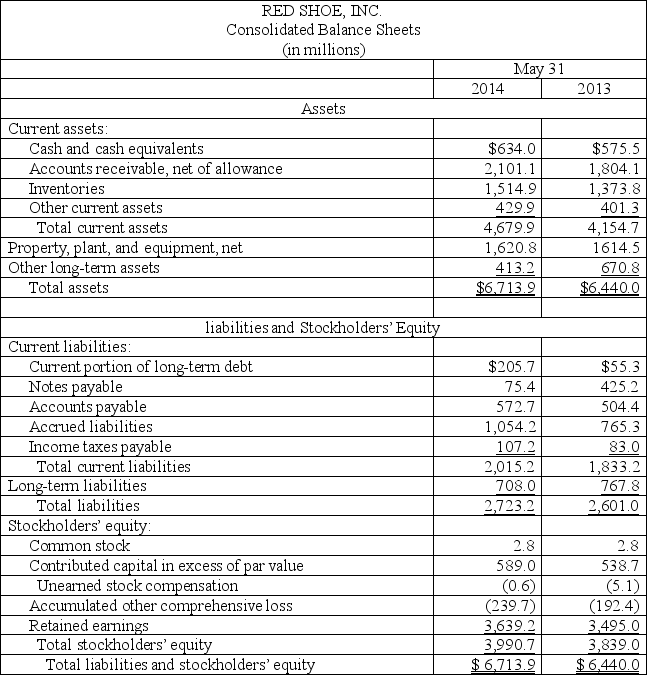

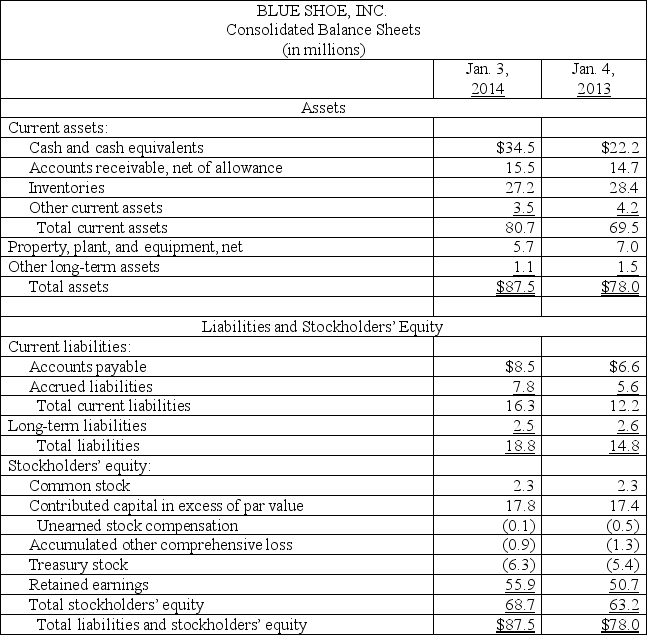

The following are summaries from the income statements and balance sheets of Red Shoe, Inc. and Blue Shoe, Inc.

RED SHOE, ПNC.

RED SHOE, ПNC.

Consolidated Statement of Income

May 31, 2014

(in millions)

BLUE SHOE, INC

BLUE SHOE, INC

Consolidated Statement of Income

January 3, 2014

(in millions)

(1) For both companies compute the following ratios for 2014:

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies compute the following ratios for 2014:

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Likelihood

The probability or chance that a particular event will occur.

Evolutionary Theory

A scientific theory that proposes organisms change over time through processes such as natural selection and genetic mutation, leading to the diversity of life seen today.

Procreate

The act of reproducing or generating offspring, a basic biological process across various species, including humans.

Intoxicated

A state of being impaired by alcohol or drugs.

Q1: Choosing the decision with the maximum possible

Q3: When Alpha punishes Beta with a retaliatory

Q17: In order to maximize profit, how many

Q35: The firm should _ because _.<br>A) shut

Q44: The present value factor for determining the

Q45: A company borrows money from the bank

Q51: Consider the short-run supply curve for a

Q105: A company had a market price of

Q128: A company reported net income for 2012

Q164: Texana Inc. imports inventory from Mexico. Prepare