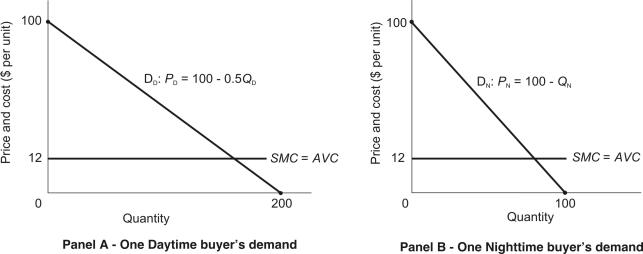

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Assuming the firm will serve both daytime and nighttime buyers, what is the MCf function?

Definitions:

Real GDP

GDP adjusted for inflation, offering a clearer view of the economy's actual size and its growth trajectory.

Household Production

Goods and services produced by members of a household, for their own consumption, without involving market transactions.

Illegal Production

The manufacture or production of goods and services that is not authorized by law, typically involving prohibited items or without necessary permits.

National Income

National income is the total amount of money earned within a country, including wages, rent, interest, and profits, after accounting for depreciation and indirect business taxes.

Q1: Suppose the marketing director ignores the nighttime

Q5: Which of the following is FALSE?<br>A) A

Q6: Social economic efficiency means that the market

Q11: Using the equal probability rule the decision

Q42: Which of the follow is NOT a

Q54: For a short-run production function in which

Q70: Current assets divided by current liabilities is

Q86: The following graph shows one of a

Q101: Investments in debt and equity securities that

Q142: The return on total assets ratio is