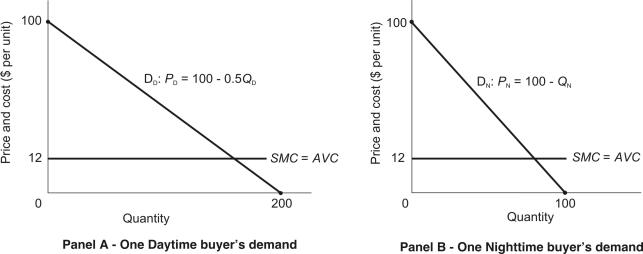

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-How much profit will the firm earn by charging the optimal access charge and optimal access fee (remember that there are 50 daytime and 50 nighttime buyers) ?

Definitions:

Retirement Savings

Retirement savings are funds that individuals set aside during their working years to support themselves financially during retirement, often utilizing accounts like 401(k)s or IRAs.

Compounded Monthly

This refers to the technique of computing interest monthly by taking into account not just the initial amount invested but also the interest that has been accrued in earlier periods.

IRA

Individual Retirement Account, a tax-advantaged investing tool that individuals use to earmark funds for retirement savings.

After taxes

Refers to the net income after all tax expenses have been deducted.

Q10: Using the minimax regret rule the decision

Q39: If price falls from $20 to $10,

Q47: What is the variance of project B?<br>A)

Q52: The marginal rate of technical substitution at

Q79: A firm is using 50 units of

Q83: The following information is from Omega

Q87: Which of the following combinations of capital

Q104: Mian, Inc., sells American gourmet foods to

Q107: Suppose that a profit-maximizing monopolist has a

Q158: Short-term investments:<br>A) Are securities that management intends