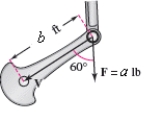

Both the magnitude and direction of the force on a crankshaft change as the crankshaft rotates.Vectors representing the position of the crank and the force are and respectively.The magnitude of the torque on the crank is given by ,find the magnitude of the torque on the crank shaft using the position and data shown in the figure.

Definitions:

Merchandisers

Businesses that purchase goods for resale at a profit, dealing primarily in tangible products that are marketed to consumers or other businesses.

Credit

An accounting entry that increases a liability or equity account, or decreases an asset or expense account; also refers to the provision of resources based on a trust agreement.

Sales Tax

A tax imposed by governments on the sale of goods and services.

Total Revenue

The entire amount of income generated by the sale of goods, services, or other financial assets before any deductions are made.

Q36: Select the graph of the following

Q127: Find the area of the parallelogram

Q145: Find a set of symmetric equations

Q164: Use the graph to find

Q193: Find the magnitude of v.

Q196: Find the derivative of the function.

Q251: Select the curve represented by the

Q310: Find the center and vertices which

Q328: Select the curve represented by the

Q373: Find the standard form of the