Tribune Company Acquires the Times Mirror Corporation

in a Tale of Corporate Intrigue

Background: Oh, What Tangled Webs We Weave. .

. CEO Mark Willes had reason to be optimistic about the future. Operating profits had grown at a double-digit rate, and earnings per share had grown at a 55% annual rate between 1995 to 1999. Many shareholders appeared to be satisfied. However, some were not. Although pleased with the improvement in profitability, they were concerned about the long-term growth prospects of the firm. Reflecting this disenchantment, Times Mirror’s largest shareholder, the Chandler family, was contemplating the sale of the company and along with it the crown jewel Los Angeles Times. It had been assumed for years that the Chandler family trusts made a sale of Times Mirror out of the question. The Chandler’s super voting stock (i.e., stock with multiple voting rights) allowed them to exert a disproportionate influence on corporate decisions. The Chandler Trusts controlled more than two-thirds of voting shares, although the family owned only about 28% of the total shares of the outstanding stock.

In May 1999 the Tribune Chairman John Madigan contacted Willes and made an offer for the company, but Willes, with the help of his then-chief financial officer (CFO), Thomas Unterman, made it clear to Madigan that the company was not for sale. What Willes did not realize was that Unterman soon would be serving in a dual role as CFO and financial adviser to the Chandlers and that he would eventually step down from his position at Times Mirror to work directly for the family. In his dual role, he worked without Willes’ knowledge to structure the deal with the Tribune.

Following months of secret negotiations, the Chicago-based Tribune Company and the Times Mirror Corporation announced a merger of the two companies in a cash and stock deal valued at approximately $7.2 billion, including $5.7 billion in equity and $1.5 billion in assumed debt. The transaction, announced March 13, 2000, created a media giant that has national reach and a major presence in 18 of the nation’s top 30 U.S. markets, including New York, Los Angeles, and Chicago. The combined company has 22 television stations, four radio stations, and 11 daily newspapers—including the Los Angeles Times, the nation’s largest metropolitan daily newspaper and flagship of the Times Mirror chain.

Transaction Terms: Tribune Shareholders Get Choice of Cash or Stock

The Tribune agreed to buy 48% of the outstanding Times Mirror stock, about 28 million shares, through a tender offer. After completion of the tender offer, each remaining Times Mirror share would be exchanged for 2.5 shares of Tribune stock. Under the terms of the transaction, Times Mirror shareholders could elect to receive $95 in cash or 2.5 shares of Tribune common stock in exchange for each share of Times Mirror stock. Holders of 27.2 million shares of Times Mirror stock elected to receive Tribune stock, whereas holders of 10.6 million elected to receive cash. Because the amount of cash offered in the merger was limited and the cash election was oversubscribed, Times Mirror shareholders electing to receive cash actually received a combination of cash and stock on a pro rata basis (Table 1).

share of Tribune stock.

in cash +1.4025 shares of Tribune stock per share for each Times Mirror share remaining

Equals 2.5 shares per Tribune share.

Times Mirror share price on announcement date of times .

The total number of new Tribute shares issued equals or

Newspaper Advertising Revenues Continue to Shrink

Most U.S. newspapers are mired in the mature or declining phase of their product life cycle. For the past half-century, newspapers have watched their portion of the advertising market shrink because of increased competition from radio and television. By the early 1990s, all major media began taking a significant hit in their advertising revenue streams as businesses discovered that direct mail could target their message more precisely. Moreover, consolidation among major retailers further reduced the size of advertising dollar pool. The same has happened with numerous large supermarket chain mergers. Newspaper advertising revenues also have been threatened by increasing competition from advertising and editorial content delivered on the internet. Finally, newspapers simply have become less attractive places to advertise as readership continues to decline as a result of an aging population and new generations that do not see newspapers as relevant.

Times Mirror: A Largely Traditional Business Model

As essentially a traditional newspaper, Times Mirror publishes five metropolitan and two suburban daily newspapers, a variety of magazines, and professional information such as flight maps for commercial airline pilots. The Los Angeles Times, a southern California institution founded in 1881, is Times Mirror’s largest holding and operates some two dozen expensive foreign news bureaus—more than any other newspaper in the country. The Los Angeles Times has more than 1200 Los Angeles Times reporters and editors around the world (CNNfn, March 13, 2000).

Tribune Company Profile: The Face of New Media?

Unlike the Times Mirror, Tribune has built its strategy around four business groups: broadcasting, publishing, education, and interactive. The Tribune is also an equity investor in America Online and other leading internet companies, underscoring the company’s commitment to new-media technologies. Applying leading edge new-media technology has allowed the Tribune to transform they way it does business, and the technology commitment creates the opportunity for future growth. The internet has been the greatest driver for change, and the Tribune’s interactive business group continues to focus on capitalizing on emerging Web technologies. Throughout the company, new technologies have been applied aggressively to create new products, improve existing products, and make operations more efficient. The Tribune’s non-newspaper revenues accounted for more than half of its earnings by 2000.

Anticipated Synergy

Cost Savings: Opportunities Abound

Cost savings are expected because of the closing of selected foreign and domestic news bureaus, a reduction in the cost of newsprint through greater volume purchases, the closing of the Times Mirror corporate headquarters, and elimination of corporate staff. Such savings are expected to reach $200 million per year (Table 2).

Assumes Tribune will close overlapping bureaus in United States (9) and most of the Times Mirror's foreign bureaus ( 21 abroad).

As a result of bulk purchasing and more favorable terms with different suppliers, of the newsprint expense of the combined companies is expected to be saved.

Layoffs of 120 L.A. Times Mirror Corporate Office personnel at an average salary of and benefits equal to of base salaries. Total payroll expenses equal (i.e., ). Lease, travel and entertainment, and other support expenses added another million.

Source: Moore, Kathryn, Tim Schnabel, and Mark Yemma, "A Media Marriage," paper prepared for Chapman University, EMBA 696, May 18,2000 , p. 9.

Revenue: Great Potential . . . But Is It Achievable?

The combined companies will have a major presence in 18 of the nation’s top 30 U.S. advertising markets, including New York, Los Angeles, and Chicago. The combined companies provide unprecedented opportunities for advertisers to reach major market consumers in any media form—broadcast, newspapers, or interactive. In addition, the combined companies will benefit consumers by giving them rich and diverse choices for obtaining the news, information, and entertainment they want anytime, anywhere. These factors provide an increased ability to capture national advertising in the most important U.S. population centers. The significantly greater breadth of the combined firm’s geographic coverage is expected to boost advertising revenues from about 3% to 6% annually.

Integration Challenges: Cultural Warfare?

Based on the current, traditional culture found at the Los Angeles Times and other Times Mirror properties, integration following the merger was likely to be slow and painful. Concerns among journalists about spreading their talents thin across three or four media—print, television, online, and radio—in the course of a day’s work raised the stress level. Although the Tribune has been able to make the transition to a largely multimedia company more rapidly than the more traditional newspapers, it has been costly. For example, development losses in 1999 were $30–35 million at Chicagotribune.com and an estimated $45 million in 2000. The bleeding was expected to continue for some time and to constitute a major distraction for the management of the new company.

Financial Analysis

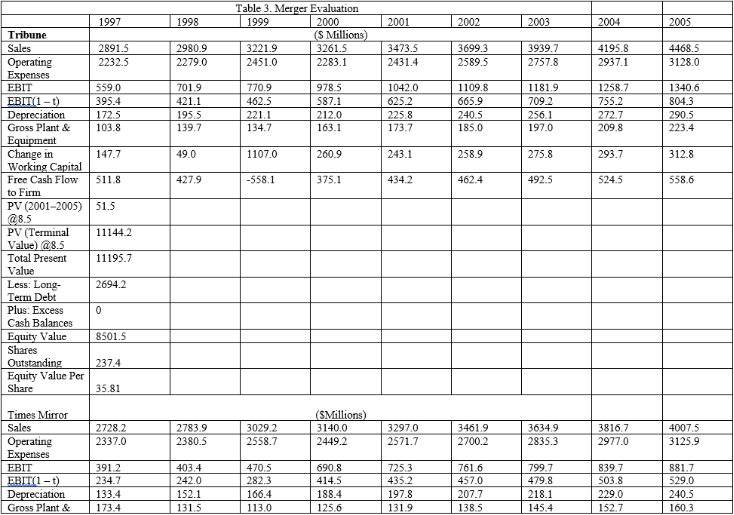

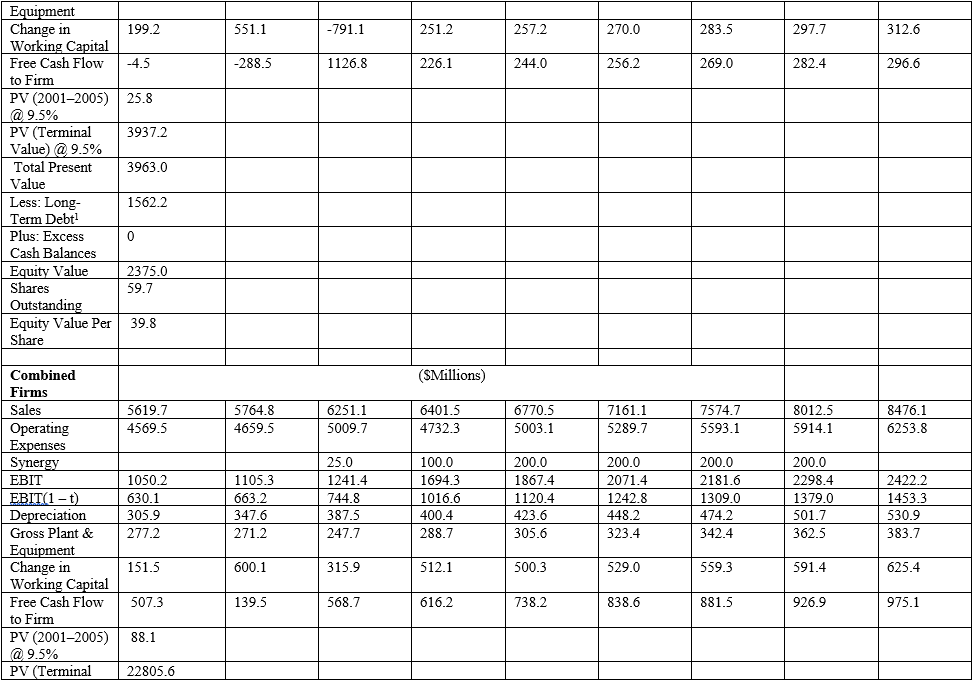

The present values of the Tribune, Times Mirror, and the combined firms are $8.5 billion, $2.4 billion, and $16.5 billion, respectively; the estimated present value of synergy is $5.6 billion (Table 3). This assumes that pretax cost savings are phased in as follows: $25 million in 2000, $100 million in 2001, and $200 million thereafter. The cost savings are net of all expenses related to realizing such savings such as severance, lease buyouts, and legal fees. Table 4 describes how the initial offer price could have been determined and the postmerger distribution of ownership between Times Mirror and Tribune shareholders.

Epilogue

Only time will tell if actual returns to shareholders in the combined Tribune and Times Mirror company exceed the expected financial returns provided in the valuation models in this case study. Times Mirror shareholders earned a substantial 102% purchase price premium over the value of their shares on the day the merger was announced. Some portion of those undoubtedly “cashed out” of their investment following receipt of the new Tribune shares. However, for those former Times Mirror shareholders continuing to hold their Tribune stock and for Tribune shareholders of record on the day the transaction closed, it is unclear if the transaction made good economic sense.

-Using the Merger Evaluation table given in the case, determine the estimated equity values of Tribune, Times Mirror and the combined firms. Why is long-term debt deducted from the total present value estimates in order to obtain equity value?

Definitions:

Puberty

The developmental stage in humans and other primates marked by the onset of sexual maturity and other physiological changes.

Gender Identity

The degree to which a person feels male or female.

Born

Refers to the process of coming into life or existence; often used in the context of birth or the point at which an organism or entity begins its existence.

Intersex

A term used to describe a variety of conditions in which a person is born with reproductive or sexual anatomy that doesn't fit typical definitions of female or male.

Q11: Use the first six terms to

Q18: What could CNH have done differently to

Q19: Use the given information to evaluate

Q30: While it is legitimate for a firm

Q34: Use the limit process to find

Q39: Despite their limitations, why is the judicious

Q59: Which of the following represent important decisions

Q100: Use the limit process to find

Q114: Successfully integrated M&As are those that demonstrate

Q128: With substantially higher operating margins than Cingular,