PG&E SEEKS BANKRUPTCY PROTECTION

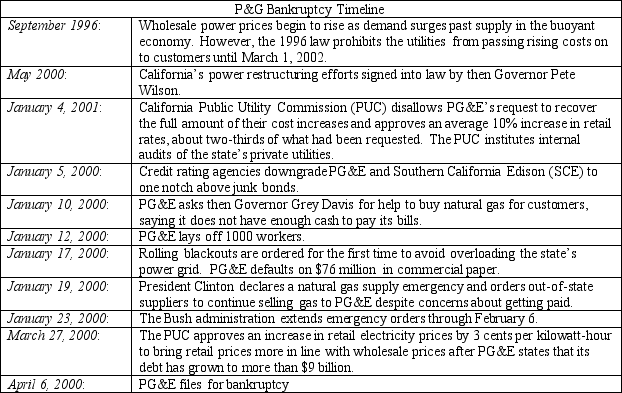

Pacific, Gas, and Electric (PG&E), the San Francisco-based utility, filed for bankruptcy on April 7, 2001, citing nearly $9 billion in debt and un-reimbursed energy costs. The utility, one of three privately owned utilities in California, serves northern and central California. The intention of the Chapter 11 reorganization was to make the utility solvent again by protecting the firm from lawsuits or any other action by those who are owed money by the utility. The bankruptcy will also allow the utility to deal with all of the firm's debts in a single forum rather than with individual debtors in what had become a highly politicized venue. The following time line outlines the firm's road to bankruptcy.

.

.

Utility industry analysts saw PG&E's move as largely an effort to escape the political paralysis that had befallen the state's regulatory apparatus. The bankruptcy filing came one day after Governor Davis dropped his opposition to raising retail rates. However, the Governor's reversal came after five month's of negotiations with the state's privately owned utilities on a rescue plan.

PG&E's common shares fell 37 percent on the day the firm filed for reorganization. Fearing a similar fate for San Diego Gas and Electric, the shares of Sempra Energy, SDG&E's parent corporation, also dropped by 35 percent

In an attempt to insulate California ratepayers from escalating wholesale electricity prices, the state entered into a series of 5-to-10 year contracts with electricity power generators that account for more than two-thirds of the state's projected power needs. The last contracts were signed by the state in June 2001. By September, a slowing economy pushed the wholesale price of electricity well below the level the state was required to pay in the "take or pay" contracts the state had just signed. Estimates suggest that California taxpayers will have to pay between $40 and $45 billion in power costs over the next decade depending on what happens to future energy costs. PG&E has continued to supply its customers without disruption or blackout while being under the protection of the bankruptcy court.

Southern California Edison, nearing bankruptcy for reasons similar to those that drove PG&E to seek protection from its creditors, reached agreement with the Public Utility Commission to pay off $3.3 billion in debt owed to power generators from customer revenues. Previously, the PUC had forbid the utility to use monies generated from two previous rate increases for this purpose. The U.S. District Court judge approved the plan on October 5, 2001. While some creditors complained that the settlement was not reassuring because it did not include a timetable for repayment of outstanding debt, others viewed the agreement as a voluntary reorganization plan without going through the expensive process of filing for bankruptcy with the federal court.

-In your judgment, did regulators attenuate or exacerbate the situation? Explain your answer.

Definitions:

Public Good

A good that is non-excludable and non-rivalrous, meaning it can be used by many people simultaneously without depletion.

Free-rider Problem

A situation in which some individuals consume more than their fair share of a public resource, or shoulder less of the cost of its production, benefiting from goods or services without paying for them.

Nonexcludable Problem

An issue characteristic of public goods, where it is not possible to prevent individuals who do not pay from consuming a good or service.

Optimal Level

The most favorable or efficient level of output or activity under given conditions, maximizing benefits or minimizing costs.

Q9: Conduct an external analysis of the smartphone

Q17: Do you believe that it is fair

Q19: A debt-for-equity swap occurs when the distressed

Q45: Why would creditors make concessions to a

Q68: Financial models are of little value in

Q71: The Herfindahl-Hirschman Index is a measure of

Q85: U.S. bankruptcy laws and practices focus on

Q94: Studies show that which of the following

Q124: Purchasing the target firm's stock in the

Q138: The accumulation of a target firm's stock