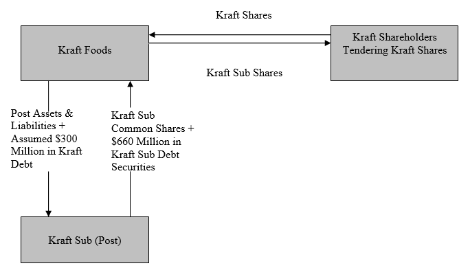

Step 1: Kraft creates a shell subsidiary (Kraft Sub) and transfers Post assets and liabilities and $300 million in Kraft debt into the shell in exchange for Kraft Sub stock plus $660 million in Kraft Sub debt securities. Kraft also implements an exchange offer of Kraft Sub for Kraft common stock.

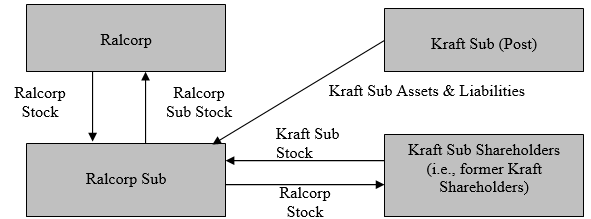

Step 2: Kraft Sub, as an independent company, is merged in a forward triangular tax-free merger with a sub of Ralcorp (Ralcorp Sub) in which Kraft Sub shares are exchanged for Ralcorp shares, with Ralcorp Sub surviving.

Sara Lee Attempts to Create Value through Restructuring

After spurning a series of takeover offers, Sara Lee, a global consumer goods company, announced in early 2011 its intention to split the firm into two separate publicly traded companies. The two companies would consist of the firm’s North American retail and food service division and its international beverage business. The announcement comes after a long string of restructuring efforts designed to increase shareholder value. It remains to be seen if the latest effort will be any more successful than earlier efforts.

Reflecting a flawed business strategy, Sara Lee had struggled for more than a decade to create value for its shareholders by radically restructuring its portfolio of businesses. The firm’s business strategy had evolved from one designed in the mid-1980s to market a broad array of consumer products from baked goods to coffee to underwear under the highly recognizable brand name of Sara Lee into one that was designed to refocus the firm on the faster-growing food and beverage and apparel businesses. Despite acquiring several European manufacturers of processed meats in the early 1990s, the company’s profits and share price continued to flounder.

In September 1997, Sara Lee embarked on a major restructuring effort designed to boost both profits, which had been growing by about 6% during the previous five years, and the company’s lagging share price. The restructuring program was intended to reduce the firm’s degree of vertical integration, shifting from a manufacturing and sales orientation to one focused on marketing the firm’s top brands. The firm increasingly viewed itself as more of a marketing than a manufacturing enterprise.

Sara Lee outsourced or sold 110 manufacturing and distribution facilities over the next two years. Nearly 10,000 employees, representing 7% of the workforce, were laid off. The proceeds from the sale of facilities and the cost savings from outsourcing were either reinvested in the firm’s core food businesses or used to repurchase $3 billion in company stock. 1n 1999 and 2000, the firm acquired several brands in an effort to bolster its core coffee operations, including such names as Chock Full o’Nuts, Hills Bros, and Chase & Sanborn.

Despite these restructuring efforts, the firm’s stock price continued to drift lower. In an attempt to reverse the firm’s misfortunes, the firm announced an even more ambitious restructuring plan in 2000. Sara Lee would focus on three main areas: food and beverages, underwear, and household products. The restructuring efforts resulted in the shutdown of a number of meat packing plants and a number of small divestitures, resulting in a 10% reduction (about 13,000 people) in the firm’s workforce. Sara Lee also completed the largest acquisition in its history, purchasing The Earthgrains Company for $1.9 billion plus the assumption of $0.9 billion in debt. With annual revenue of $2.6 billion, Earthgrains specialized in fresh packaged bread and refrigerated dough. However, despite ongoing restructuring activities, Sara Lee continued to underperform the broader stock market indices.

In February 2005, Sara Lee executed its most ambitious plan to transform the firm into a company focused on the global food, beverage, and household and body care businesses. To this end, the firm announced plans to dispose of 40% of its revenues, totaling more than $8 billion, including its apparel, European packaged meats, U.S. retail coffee, and direct sales businesses.

In 2006, the firm announced that it had completed the sale of its branded apparel business in Europe, Global Body Care and European Detergents units, and its European meat processing operations. Furthermore, the firm spun off its U.S. Branded Apparel unit into a separate publicly traded firm called HanesBrands Inc. The firm raised more than $3.7 billion in cash from the divestitures. The firm was now focused on its core businesses: food, beverages, and household and body care.

In late 2008, Sara Lee announced that it would close its kosher meat processing business and sold its retail coffee business. In 2009, the firm sold its Household and Body Care business to Unilever for $1.6 billion and its hair care business to Procter & Gamble for $0.4 billion.

In 2010, the proceeds of the divestitures made the prior year were used to repurchase $1.3 billion of Sara Lee’s outstanding shares. The firm also announced its intention to repurchase another $3 billion of its shares during the next three years. If completed, this would amount to about one-third of its approximate $10 billion market capitalization at the end of 2010.

What remains of the firm are food brands in North America, including Hillshire Farm, Ball Park, and Jimmy Dean processed meats and Sara Lee baked goods and Earthgrains. A food distribution unit will also remain in North America, as will its beverage and bakery operations. Sara Lee is rapidly moving to become a food, beverage, and bakery firm. As it becomes more focused, it could become a takeover target.

Has the 2005 restructuring program worked? To answer this question, it is necessary to determine the percentage change in Sara Lee’s share price from the announcement date of the restructuring program to the end of 2010, as well as the percentage change in the share price of HanesBrands Inc., which was spun off on August 18, 2006. Sara Lee shareholders of record received one share of HanesBrands Inc. for every eight Sara Lee shares they held.

Sara Lee’s share price jumped by 6% on the February 21, 2004 announcement date, closing at $19.56. Six years later, the stock price ended 2010 at $14.90, an approximate 24% decline since the announcement of the restructuring program in early 2005. Immediately following the spinoff, HanesBrands’ stock traded at $22.06 per share; at the end of 2010, the stock traded at $25.99, a 17.8% increase.

A shareholder owning 100 Sara Lee shares when the spin-off was announced would have been entitled to 12.5 HanesBrands shares. However, they would have actually received 12 shares plus $11.03 for fractional shares (i.e., 0.5 × $22.06).

A shareholder of record who had 100 Sara Lee shares on the announcement date of the restructuring program and held their shares until the end of 2010 would have seen their investment decline 24% from $1,956 (100 shares × $19.56 per share) to $1,486.56 by the end of 2010. However, this would have been partially offset by the appreciation of the HanesBrands shares between 2006 and 2010. Therefore, the total value of the hypothetical shareholder’s investment would have decreased by 7.5% from $1,956 to $1,809.47 (i.e., $1,486.56 + 12 HanesBrands shares × $25.99 + $11.03). This compares to a more modest 5% loss for investors who put the same $1,956 into a Standard & Poor’s 500 stock index fund during the same period.

Why did Sara Lee underperform the broader stock market indices during this period? Despite the cumulative buyback of more than $4 billion of its outstanding stock, Sara Lee’s fully diluted earnings per share dropped from $0.90 per share in 2005 to $0.52 per share in 2009. Furthermore, the book value per share, a proxy for the breakup or liquidation value of the firm, dropped from $3.28 in 2005 to $2.93 in 2009, reflecting the ongoing divestiture program. While the HanesBrands spin-off did create value for the shareholder, the amount was far too modest to offset the decline in Sara Lee’s market value. During the same period, total revenue grew at a tepid average annual rate of about 3% to about $13 billion in 2009.

-Speculate as to why the 2005 restructure program appears to have been unsuccessful in achieving a sustained increase in Sara Lee's earnings per share and in turn creating value for the Sara Lee shareholders?

Definitions:

WARN Act

The Worker Adjustment and Retraining Notification Act that requires employers to provide notice in advance of certain plant closings and mass layoffs.

Employee Leasing

A staffing arrangement where a leasing firm hires and manages employees, then contracts them out to work for another company, effectively outsourcing the HR functions.

Voluntary Early Retirement

A program offered by employers allowing employees to retire earlier than the traditional retirement age, often with full or partial benefits.

Stock Options

Financial incentives given to employees, granting them the right to buy the company's stock at a set price within a certain period.

Q12: Termination provisions in the alliance agreement should

Q18: LBO investors seldom sell assets to repay

Q20: Compare and contrast the Chesapeake and Unocal

Q36: How did changes in Hughes' external environment

Q43: When is a person or firm required

Q44: Licensing allows a firm to purchase the

Q88: The term financial distress could apply to

Q95: Factors destroying firm value following a merger

Q102: LBO capital structures are often very complex,

Q129: The promissory note commits the borrower to