General Electric and Comcast Join Forces

Joint ventures are sometimes created if a business cannot be sold outright.

Such JVs are viewed as a way of improving a firm’s operations enabling the parent to exit the business eventually at a higher value.

In an effort to shore up its big finance business, severely weakened during the 2008 financial crisis, and to focus more on its manufacturing and infrastructure operations, General Electric (GE) sought to sell its media and entertainment business, NBCUniversal. GE’s decision to sell also reflected the deteriorating state of the broadcast television industry and a desire to exit a business that never quite fit with its industrial side. NBC has been mired in fourth place among the major broadcast networks, and the economics of the broadcast television industry have deteriorated in recent years amid declining overall ratings and a reduction in advertising. In contrast, cable channels have continued to thrive because they rely on a steady stream of subscriber fees from cable companies such as Comcast. Moreover, while NBCUniversal was profitable in 2009, it was expected to go into the red in subsequent years.

Unable to find a buyer for the entire business at what GE believed was a reasonable price, GE sought other options, including combining the operation with another media business. After extended discussions, GE and Comcast announced a deal on December 2, 2009, to form a joint venture consisting of NBCUniversal and selected Comcast assets. Comcast is primarily a cable company and provider of programming content, with 24.3 million cable customers, 16.1 million high-speed Internet customers, and 7.8 million voice customers. Comcast hopes to diversify its holdings as it faces encroaching threats from online video and more aggressive competition from satellite and phone companies that offer subscription TV services, by adding more content on its video-on-demand offerings. Furthermore, by having an interest in NBCUniversal’s digital properties, such as Hulu.com, Comcast expects to capitalize on any shift of its cable customers to viewing their favorite TV programs online by owning the program content.

Comcast’s strategy is to integrate vertically by owning the content it distributes through its cable operations. Previous attempts to do this, such as AOL’s acquisition of Time Warner in 2001, have ended in failure, largely because the cultures of the two firms did not mesh. Some media companies have merged successfully —for example, Time Warner’s merger with Turner Broadcasting. Having learned from AOL’s rush to achieve synergy, Comcast is allowing the NBCUniversal JV to operate independent of the parents and is sharing the risk with GE.

This joint venture transaction is noteworthy for its potential impact on limiting competition in the entertainment industry, its complex financial engineering, and its multifaceted organizational structure and as an exit strategy for GE from the media and entertainment business. Each of these considerations is discussed next.

The announcement raised significant concerns within the media and entertainment industry about the potential for limiting access to both content and distribution by increasing industry concentration. After receiving significant concessions, regulators approved the creation of the joint venture media giant on January 17, 2011. The U.S. Federal Communications Commission and the Department of Justice required Comcast and NBCUniversal to relinquish voting rights and board representation to Hulu, although they could continue to remain part owners. Furthermore, Comcast has to ensure what the FCC called “reasonable access” to its programming for its competitors, and the firm may not discriminate against programming that competes with its own offerings.

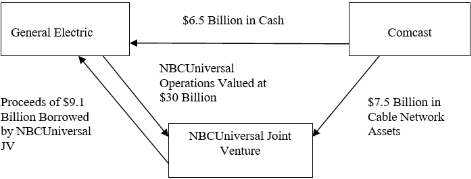

The deal reflected complicated financial engineering, involving both parties contributing assets to create a joint venture, agreeing on the total value of the endeavor, determining the value of each party’s contributed assets to determine ownership distribution, and finally determining how GE would be compensated. The joint venture transaction based on the value of the assets contributed by both parties was valued at $37.25 billion, consisting of GE’s contribution of NBCUniversal, valued at $30 billion, and Comcast’s contribution of cable network assets valued at $7.25 billion. The ownership interests were determined based on the value of the contributed assets and cash payments made to GE as described in Figure 15.1.

In exchange for contributing NBCUniversal operations valued at $30 billion to the JV, GE received $15.6 billion in cash ($6.5 billion from Comcast + $9.1 billion borrowed by the NBCUniversal JV) + a 49% ownership interest in the NBCUniversal JV).

In exchange for contributing $7.5 billion in cable network assets to the JV and paying GE $6.5 billion in cash, Comcast received a 51% interest in the NBCUniversal JV.

NBCUniversal Joint Venture at Closing.

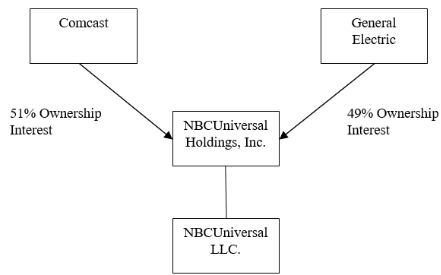

Organizationally, the two parties own NBCUniversal indirectly through their ownership in a holding company (see Figure 15.2). As part of the deal, NBCUniversal Inc. was converted to a limited liability company (NBCUniversal Media LLC), which is a wholly owned subsidiary of NBCUniversal Holdings Inc., a corporation in which Comcast owns 51% of the outstanding shares and GE the remainder. NBCUniversal Holdings is the sole member (owner) in NBCUniversal Media LLC. By having the right to designate the majority of the board members of NBCUniversal Holdings, Comcast effectively controls the holding company and, in turn, NBCUniversal Media LLC. To maintain its status as a pass-through organization for tax purposes, NBCUniversal Media makes quarterly distributions to the holding company, which has no independent source of income, to meet its cash requirements. Among other things, these obligations include making cash distributions to Comcast and GE so that they can pay taxes due on the income generated by NBCUniversal Media. As long as GE retains at least a 20% ownership interest in the combined firms, it has certain approval rights over acquisitions, mergers, dissolution, bankruptcy, material expansion of the business, dividend payouts, new equity issues or repurchase, additional borrowing in excess of working capital requirements, loan guarantees, and other actions that could affect the value of its investment.

NBCUniversal Postclosing Organization

Finally, the deal enables General Electric to pursue a staged exit of NBCUniversal over a number of years. In doing so, GE hopes that the potential synergy with Comcast will increase substantially the value of its share of the joint venture. GE has redemption rights (a put option) during the six months beginning January 28, 2014, to redeem one-half of its interest in NBCUniversal Holdings. In the six months beginning on January 28, 2018, GE can redeem its remaining interest. Comcast is committed to funding $2.9 billion for each of the two redemptions, payable in cash and stock up to $5.8 billion to the extent NBCUniversal Media cannot fund the redemptions. The purchase price to be paid with any redemption by GE will be 120% of the “public market trading value” of NBCUniversal Holding, to be determined by an appraisal if the business is not yet publicly traded, less 50% of the “public market trading value” greater than $28.4 billion. After January 28, 2014, GE may transfer its interest to a third party, subject to Comcast’s having the right of first offer (first refusal). Comcast has a call option to buy out GE after the same dates designated for GE’s put option at the same price required under the put option.

In 2011, NBCUniversal Media had revenue of $19.3 billion, earnings before interest and taxes of $2.3 billion, and net income of $1.7 billion. While the financial outlook for the business has stabilized, the deal continues to be subject to the criticism that there is little overlap between Comcast and NBCUniversal Media’s businesses to provide significant cost savings. Moreover, big media deals have a poor track record, as illustrated by the AOL Time Warner debacle. Comcast is placing a big bet that it will be able to combine content and distribution successfully and to grow the value of the consolidated businesses. In contrast, General Electric may be more intent on exercising its option to sell its interests unless the fortunes of NBCUniversal Media improve dramatically in the coming years.

-Why did Comcast and GE choose to operate NBCUniversal as a limited liability company rather than a corporation?

Definitions:

Operating Income

An indication of a company's profitability from its core business operations, excluding income and expenses from unusual, non-operational activities.

Contribution Margin

The amount by which a product's sales price exceeds its variable costs, contributing to covering fixed costs and generating profit.

Fixed Costs

Expenses that do not change in total despite fluctuations in the level of output or sales volume, such as rent or salaries.

Operating Income

The profit realized from a business's core operations, excluding income from investments and the effects of taxes and interest.

Q14: The form of payment does not affect

Q30: Identify at least two financial or non-financial

Q30: Which of the following is generally not

Q50: Discuss the circumstances under which a non-U.S.

Q65: Foreign companies having a minority ownership position

Q67: A corporate structure is the preferred post-closing

Q84: Explain why Sara Lee may have chosen

Q94: What do you believe are the key

Q111: The interest rate parity theory relates forward

Q113: Why was this transaction subject to the