Case Study Short Essay Examination Questions

Hollywood’s Biggest Independent Studios Combine in a Leveraged Buyout

LBOs allow buyouts using relatively little cash and often rely heavily on the target firm’s assets to finance the transaction.

Private equity investors often “cash out” of their investments by selling to a strategic buyer.

______________________________________________________________________________

The Lionsgate-Summit tie-up represented the culmination of more than four years of intermittent discussions between the two firms. The number of studios making and releasing movies has been shrinking amid falling DVD sales and continued efforts to transition to digital distribution. As the largest independent studios in Hollywood, both firms saw their cash flow whipsawed as one blockbuster hit would be followed by a series of failures. Film and TV program libraries offered the only source of cash flow stability due to the recurring fees paid by those licensing the rights to use this proprietary content.

Lionsgate first approached Summit about a buyout in 2008 in an effort to bolster its film and TV library. However, it was not until early 2012 that the two sides could reach agreement. The time was ripe because Summit’s investors were looking for a way to cash in on the success of the firm’s Twilight movies series. Consisting of four films, this series had grossed $2.5 billion worldwide. On February 2, 2012, Lionsgate announced that it had reached an agreement to acquire Summit Entertainment by paying Summit shareholders $412.5 million in cash and stock for all of their outstanding shares and assumed debt of $506.3 million. According to the merger agreement, Lionsgate would provide administrative, production, and distribution services to Summit for a 10% servicing fee. Layoffs are expected at both firms as they merge redundant departments in their film operations, such as marketing, production, and distribution. The acquisition provides a windfall to Summit’s investors, including eBay cofounder Jeff Skoll’s film company Media and private equity fund Traverse Management. These investors had previously received a $200 million dividend as part of a recapitalization in early 2011 and gained handsomely from the sale to Lionsgate.

Lionsgate is a diversified film and television production and distribution company, with a film library of 13,000 titles. The firm’s major distribution channels include home entertainment and prepackaged media (DVDs); digital distribution (on-demand TV) and pay TV (premium network programming). Summit, also a producer and distributor of film and TV content, has a less consistent track record in realizing successful releases, with the Twilight “franchise” its primary success. However, Summit does have strong international licensing operations, with arrangements in the United States, Canada, Germany, France, Scandinavia, Spain, and Australia. The acquisition also strengthens Lionsgate’s position as a leading content supplier and, controlling the Twilight and Hunger Games franchises, positions Lionsgate as a market leader for young adult audiences. The combination also results in cost and revenue synergies, more diversified cash flow streams, and greater access to international distribution channels.

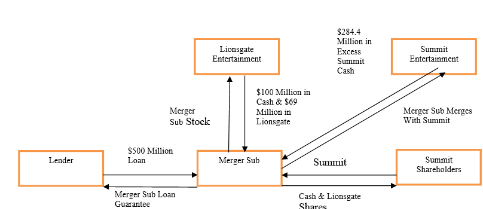

Figure 13.3 illustrates the subsidiary structure for completing the buyout of Summit Entertainment LLC. As is typical of such transactions, Lionsgate created a merger subsidiary (Merger Sub) and funded the subsidiary with its equity contribution of $100 million in cash and $69 million in Lionsgate stock, receiving 100% of the subsidiary’s stock in exchange. Merger Sub was further capitalized by a bank term loan of $500 million. Following a tender offer to Summit’s shareholders by Merger Sub, Merger Sub was merged into Summit Entertainment, with Summit surviving as a wholly owned subsidiary of Lionsgate in a reverse triangular merger. At closing, $284.4 million of Summit’s excess cash was used to finance the total cost of the deal.

Lionsgate-Summit Legal and Financing Structure.

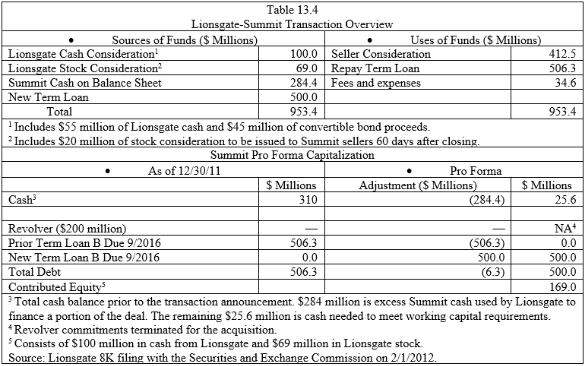

Table 13.4 summarizes the sources of financing for the buyout and shows how these funds were used to pay for the deal. Lionsgate financed the total cost of the deal of $953.4 million (consisting of $412.5 million for Summit stock + the pretransaction term loan of $506.3 million + $34.6 million in transaction-related fees and expenses) as follows: $100 million in cash from Lionsgate and $69 million in Lionsgate stock + $284.4 million of the $310 million in cash on Summit’s balance sheet at closing + a new $500 million term loan. Summit’s $506.3 million term loan B was refinanced with the new term loan for $500 million as part of the transaction. The new term loan is an obligation of and is secured by the assets of Summit and its subsidiaries. It also is secured by a loan guarantee provided by Merger Sub, created by Lionsgate to consummate the transaction. The guarantee is secured by the equity in Summit held by Merger Sub. Lionsgate anticipates paying off the term loan well in advance of its 2016 maturity date out of future cash flows from new movie releases. Summit’s pretransaction net debt was $196.3 million (pretransaction term loan of $506.3 less total cash on the balance sheet of $310 million). Postclosing net debt increased to $474.4 million (postclosing term loan of $500 million less $25.6 million in total cash of the balance sheet).

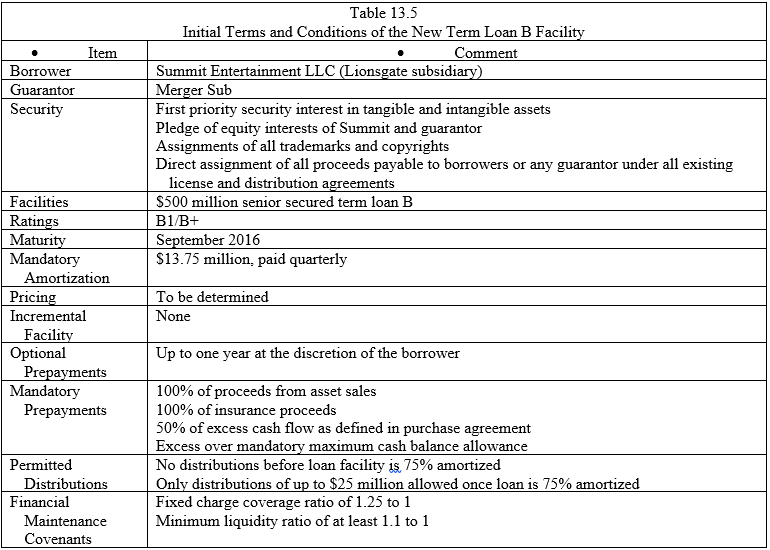

presents the key features of the new term loan B facility. Note how Summit’s assets are used as collateral to secure the loan. In addition, the lender has first priority on the proceeds from certain types of transactions, giving them priority access to such funds. Cash distributions are not possible until the loan is almost paid off, and even then the size of such distributions is limited. Finally, loan covenants require Summit to maintain a comparatively liquid position during the term of the loan.

-Speculate as to why Lionsgate refinanced as part of the transaction the existing Summit Term Loan B due in 2016 that had been borrowed in the early 2000s.

Definitions:

Declaration of War

A declaration of war is a formal act by which one nation goes to war against another, typically requiring approval by the legislature in democratic countries.

Executive Office

A branch of government responsible for enforcing laws and managing the administration of public policy, typically headed by the President or Prime Minister.

President

The elected head of state and government in a republic, particularly referring to the President of the United States.

Agencies

Organizations or bodies established by the government to perform specific functions, often involved in administering policy and regulation in various areas.

Q2: Voluntary bust-ups or liquidations by the parent

Q10: Sellers who are structured as C corporations

Q18: Unlike other legal forms, the C corporate

Q20: How might the additional product and geographic

Q36: The written contract is the simplest legal

Q110: Is this transaction taxable or non-taxable to

Q118: In partnerships, the allocation of profits and

Q132: Overpayment is the leading factor contributing to

Q137: A joint venture rarely takes the legal

Q151: A firm decides to distribute all of