TXU Goes Private in the Largest Private Equity Transaction in History-The Dark Side of Leverage

Key Points

The 2007/2008 financial crisis left many LBOs excessively leveraged.

As structured, the TXU buyout (now Energy Future Holdings) left no margin for error.

Excessive leverage severely limits the firm's future financial options.

_____________________________________________________________________________

Before the buyout, TXU, a Dallas-based energy giant, was a highly profitable utility. Historically low interest rates and an overly optimistic outlook for natural gas prices set the stage for the largest private equity deal in history. The 2007 buyout of TXU was valued at $48 billion and, at the time, appeared to offer such promise that several of Wall Street's largest lenders --including the likes of Lehman Brothers and Citigroup-invested, along with such storied names in private equity as KKR, TPG, and Goldman Sachs. However, the price of gas plummeted, eroding TXU's cash flow. Since the deal closed in October 2007, investors who bought $40 billion of TXU's debt have experienced losses as high as 70% to 80% of their value. The other $8 billion used to finance the deal came from the private equity investors, banks, and large institutional investors. They, too, have suffered huge losses. Having met its obligations to date, the firm faces a $20 billion debt repayment coming due in 2014.

Wall Street banks were competing in 2007 to make loans to buyout firms on easier terms, with the banks also investing their own funds in the deal. The allure to the banks was the prospect of dividing up as much as $1.1 billion in fees for originating the loans, repackaging such loans into pools called collateralized loan obligations, and reselling them to long-term investors such as pension funds and insurance companies. In doing so, the loans would be removed from the banks' balance sheets, eliminating potential losses that could arise if the deal soured at a later date. Furthermore, the deal appeared to be attractive as an investment opportunity because some banks put up $500 million of their own cash for a stake in TXU.

The financial sponsor group, consisting of Kohlberg Kravis Roberts & Co, Texas Pacific Group, and Goldman Sachs, created a shell corporation, referred to as Merger Sub Parent, and its wholly owned subsidiary Merger Sub. TXU was merged into Merger Sub, with Merger Sub surviving. Each outstanding share of TXU common stock was converted into the right to receive $69.25 in cash. Total cash required for the purchase was provided by the financial sponsor group and lenders (Creditor Group) to Merger Sub. Regulatory authorities required that the debt associated with the transaction be held at the level of the Merger Sub Parent holding company so as not to leverage the utility further.

Subsequent to closing, the new company was reorganized into independent businesses under a new holding company, controlled by the Sponsor Group, called Texas Holdings (TH). Merger Sub (which owns TXU) was renamed Energy Future Holdings. TH's direct subsidiaries are EFH and Oncor (an energy distribution business formerly held by TXU). EFH's primary direct subsidiary is Texas Competitive Electric Holdings, which holds TXU's public utility operating assets and liabilities. All TXU non-Sponsor Group-related debt incurred to finance the transaction is held by EFH, while any debt incurred by the Sponsor Group is shown on the TH balance sheet. This legal structure allows for the concentration of debt in TH and EFH, separate from the cash-generating assets held by Oncor and Texas Competitive Electric Holdings.

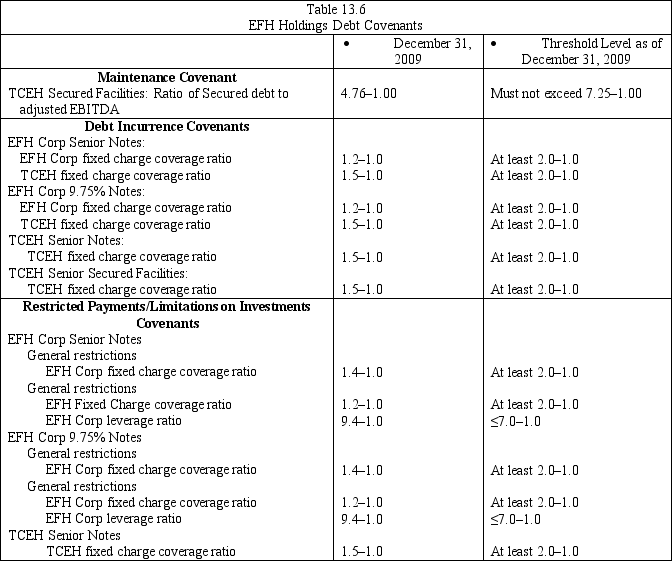

Loan covenants limit EFH's and its subsidiaries' ability to issue new debt or preferred stock; pay dividends on, repurchase, or make distributions of capital stock or make other restricted payments; make investments; sell or transfer assets; consolidate, merge, sell, or dispose of all or substantially all its assets; and repay, repurchase, or modify debt. A breach of any of these covenants could result in default. Table 13.6 illustrates selected covenants in which certain ratios must be maintained either above or below stipulated thresholds. Note that EFH was in violation of certain covenants when you compare actual December 31, 2009 (the last year for which public information is available), ratios with required threshold levels.

-December 31, 2009

-December 31, 2009

-Threshold Level as of December 31, 2009

Things clearly have not turned out as expected. The firm faces an almost-untenable capital structure. The firm's debt traded at between 20 and 30 cents on the dollar throughout most of 2012. The $8 billion equity invested in the deal has been virtually wiped out on paper. Absent a turnaround in natural gas prices, EFH is left with seeking a way to reduce substantially the burden of the pending 2014 $20 billion loan payment with its lenders through a debt-for-equity swap or more favorable terms on existing debt or by pursuing Chapter 11 bankruptcy. EFH has posted eight consecutive quarterly losses. In December 2012, in an effort to extend debt maturities to buy time for a turnaround and to reduce interest expense, EFH exchanged $1.15 billion of new payment-in-kind notes (interest is paid with more debt) for existing notes with a face value of $1.6 billion. By any measure, this transaction illustrates the dark side of leverage.

-What was the purpose of the pre-closing covenants and closing conditions as described in the merger agreement?

Definitions:

Strong Ethical Leaders

Individuals in leadership positions who exemplify high moral standards and integrity in their decision-making and behavior.

Pertinent Information

Relevant or applicable data or facts that are crucial in making a decision or solving a problem.

Coaching Leader

A leadership style focused on developing employees by providing guidance, feedback, and support for personal and professional growth.

Positive Climate

The overall mood or environmental tone within an organization that encourages positivity, cooperation, and employee satisfaction.

Q5: Increasing market liquidity will reduce the value

Q10: Acquiring Company is considering buying Target Company.

Q17: Dow Chemical, a leading chemical manufacturer, announced

Q25: Borrowers often prefer term loans because they

Q36: What are the critical assumptions that Microsoft

Q39: Both public and private firms always attempt

Q51: Who were Panda Ethanol, Grove Street Investors,

Q83: Do you believe that Heinz is a

Q92: In your judgment, do these alliances deliver

Q128: Which of the following is not a