With their cash hoards accumulating at an unprecedented rate, there was little that buyout firms could do but to invest in larger firms. Consequently, the average size of LBO transactions grew significantly during 2005. In a move reminiscent of the blockbuster buyouts of the late 1980s, seven private investment firms acquired 100 percent of the outstanding stock of SunGard Data Systems Inc. (SunGard) in late 2005. SunGard is a financial software firm known for providing application and transaction software services and creating backup data systems in the event of disaster. The company‘s software manages 70 percent of the transactions made on the Nasdaq stock exchange, but its biggest business is creating backup data systems in case a client’s main systems are disabled by a natural disaster, blackout, or terrorist attack. Its large client base for disaster recovery and back-up systems provides a substantial and predictable cash flow.

SunGard’s new owners include Silver lake Partners, Bain Capital LLC, The Blackstone Group L.P., Goldman Sachs Capital Partners, Kohlberg Kravis Roberts & Co., Providence Equity Partners Inc. and Texas Pacific Group. Buyout firms in 2005 tended to band together to spread the risk of a deal this size and to reduce the likelihood of a bidding war. Indeed, with SunGard, there was only one bidder, the investor group consisting of these seven firms.

The software side of SunGard is believed to have significant growth potential, while the disaster-recovery side provides a large stable cash flow. Unlike many LBOs, the deal was announced as being all about growth of the financial services software side of the business. The deal is structured as a merger, since SunGard would be merged into a shell corporation created by the investor group for acquiring SunGard. Going private, allows SunGard to invest heavily in software without being punished by investors, since such investments are expensed and reduce reported earnings per share. Going private also allows the firm to eliminate the burdensome reporting requirements of being a public company.

The buyout represented potentially a significant source of fee income for the investor group. In addition to the 2 percent management fees buyout firms collect from investors in the funds they manage, they receive substantial fee income from each investment they make on behalf of their funds. For example, the buyout firms receive a 1 percent deal completion fee, which is more than $100 million in the SunGard transaction. Buyout firms also receive fees paid for by the target firm that is “going private” for arranging financing. Moreover, there are also fees for conducting due diligence and for monitoring the ongoing performance of the firm taken private. Finally, when the buyout firms exit their investments in the target firm via a sale to a strategic buyer or a secondary IPO, they receive 20 percent (i.e., so-called carry fee) of any profits.

Under the terms of the agreement, SunGard shareholders received $36 per share, a 14 percent premium over the SunGard closing price as of the announcement date of March 28, 2005, and 40 percent more than when the news first leaked about the deal a week earlier. From the SunGard shareholders’ perspective, the deal is valued at $11.4 billion dollars consisting of $10.9 billion for outstanding shares and “in-the-money” options (i.e., options whose exercise price is less than the firm’s market price per share) plus $500 million in debt on the balance sheet.

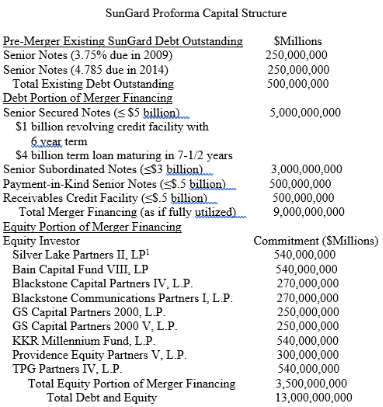

The seven equity investors provided $3.5 billion in capital with the remainder of the purchase price financed by commitments from a lending consortium consisting of Citigroup, J.P. Morgan Chase & Co., and Deutsche Bank. The purpose of the loans is to finance the merger, repay or refinance SunGard’s existing debt, provide ongoing working capital, and pay fees and expenses incurred in connection with the merger. The total funds necessary to complete the merger and related fees and expenses is approximately $11.3 billion, consisting of approximately $10.9 billion to pay SunGard’s stockholders and about $400.7 million to pay fees and expenses related to the merger and the financing arrangements. Note that the fees that are to be financed comprise almost 4 percent of the purchase price. Ongoing working capital needs and capital expenditures required obtaining commitments from lenders well in excess of $11.3 billion.

The merger financing consists of several tiers of debt and “credit facilities.” Credit facilities are arrangements for extending credit. The senior secured debt and senior subordinated debt are intended to provide “permanent” or long-term financing. Senior debt covenants included restrictions on new borrowing, investments, sales of assets, mergers and consolidations, prepayments of subordinated indebtedness, capital expenditures, liens and dividends and other distributions, as well as a minimum interest coverage ratio and a maximum total leverage ratio.

If the offering of notes is not completed on or prior to the closing, the banks providing the financing have committed to provide up to $3 billion in loans under a senior subordinated bridge credit facility. The bridge loans are intended as a form of temporary financing to satisfy immediate cash requirements until permanent financing can be arranged. A special purpose SunGard subsidiary will purchase receivables from SunGard, with the purchases financed through the sale of the receivables to the lending consortium. The lenders subsequently finance the purchase of the receivables by issuing commercial paper, which is repaid as the receivables are collected. The special purpose subsidiary is not shown on the SunGard balance sheet. Based on the value of receivables at closing, the subsidiary could provide up to $500 million. The obligation of the lending consortium to buy the receivables will expire on the sixth anniversary of the closing of the merger.

The following table provides SunGard’s post-merger proforma capital structure. Note that the proforma capital structure is portrayed as if SunGard uses 100 percent of bank lending commitments. Also, note that individual LBO investors may invest monies from more than one fund they manage. This may be due to the perceived attractiveness of the opportunity or the limited availability of money in any single fund. Of the $9 billion in debt financing, bank loans constitute 56 percent and subordinated or mezzanine debt comprises represents 44 percent.

The roman numeral II refers to the fund providing the equity capital managed by the partnership

-In what ways is this transaction similar to and different from those that were common in the 1980s? Be specific.

Definitions:

Agents Of Erosion

Natural forces like water, wind, ice, and gravity that physically or chemically break down and carry away Earth's surface material.

Ice

A solid state of water that occurs when it freezes, typically at or below 0°C (32°F).

Salinization

The process of increasing salt content in soil, often due to improper irrigation practices, leading to reduced soil fertility and negatively impacting agriculture.

Accumulate

To gather or collect a substance, objects, or information gradually over time.

Q19: Comment of the following statement. A

Q24: Why do you believe were the major

Q26: How do Swiss takeover laws compare to

Q59: Give examples of how the partners' objectives

Q73: The multiple option bidding strategy introduces a

Q83: Sellers may find a sale of assets

Q104: The risk to the bidder associated with

Q115: Describe the disadvantages of the supply agreement

Q119: Collar agreements provide for certain changes in

Q133: Typical LBO targets are in mature industries