Taking Advantage of a “Cupcake Bubble”

_____________________________________________________________________________________

Key Points

Financing growth represents a common challenge for most small businesses.

Selling a portion of the business either to private investors or in a public offering represents a common way for small businesses to finance major expansion plans.

____________________________________________________________________________

When Crumbs first opened in 2003 on the upper west side of Manhattan, the bakery offered three varieties of cupcakes among 150 other items. When the cupcakes became increasingly popular, the bakery began introducing cupcakes with different toppings and decorations. The firm’s founders, Jason and Mia Bauer, followed a straightforward business model: Hold costs down, and minimize investment in equipment. Although all of Crumbs’ cupcake recipes are Mia Bauer’s, there are no kitchens or ovens on the premises. Instead, Crumbs outsources all of the baking activities to commercial facilities. The firm avoids advertising, preferring to give away free cupcakes when it opens a new store and to rely on “word of mouth.” By keeping costs low, the firm has expanded without adding debt. The firm targets locations with high daytime “foot traffic,” such as urban markets. In 2010, the firm sold 13 million cupcakes through 34 locations, accounting for $31 million in revenue and $2.5 million in earnings before interest, taxes, and depreciation. Crumbs’ success spawned a desire to accelerate growth by opening up as many as 200 new locations by 2014. The challenge was how to finance such a rapid expansion.

The Bauers were no strangers to raising capital to finance the ongoing growth of their business, having sold one-half of the firm to Edwin Lewis, former CEO of Tommy Hilfiger, for $10 million in 2008. This enabled them to reinvest a portion in the business to sustain growth as well as to draw cash out of the business for their personal use. However, this time the magnitude of their financing requirements proved daunting. The couple was reluctant to burden the business with excessive debt, well aware that this had contributed to the demise of so many other rapidly growing businesses. Equity could be sold directly in the private placement market or to the public. Private placements could be expensive and may not provide the amount of financing needed; tapping the public markets directly through an IPO required dealing with underwriters and a level of financial expertise they lacked. Selling to another firm seemed to satisfy best their primary objectives: Get access to capital, retain their top management positions, and utilize the financial expertise of others to tap the public capital markets and to share in any future value creation.

The 57th Street General Acquisition Corporation (57th Street), a special-purpose acquisition company, or SPAC, appeared to meet their needs. In May 2010, 57th Street raised $54.5 million through an IPO, with the proceeds placed in a trust pending the completion of planned acquisitions. One year later, 57th Street announced it had acquired Crumbs for $27 million in cash and $39 million in 57th Street stock. On June 30, 2011, 57th announced that NASDAQ had approved the listing of its common stock, giving Crumbs a market value of nearly $60 million.

Panda Ethanol Goes Public in a Shell Corporation

In early 2007, Panda Ethanol, owner of ethanol plants in west Texas, decided to explore the possibility of taking its ethanol production business public to take advantage of the high valuations placed on ethanol-related companies in the public market at that time. The firm was confronted with the choice of taking the company public through an initial public offering or by combining with a publicly traded shell corporation through a reverse merger.

After enlisting the services of a local investment banker, Grove Street Investors, Panda chose to "go public" through a reverse merger. This process entailed finding a shell corporation with relatively few shareholders who were interested in selling their stock. The investment banker identified Cirracor Inc. as a potential merger partner. Cirracor was formed on October 12, 2001, to provide website development services and was traded on the over-the-counter bulletin board market (i.e., a market for very low-priced stocks). The website business was not profitable, and the company had only ten shareholders. As of June 30, 2006, Cirracor listed $4,856 in assets and a negative shareholders' equity of $(259,976). Given the poor financial condition of Cirracor, the firm's shareholders were interested in either selling their shares for cash or owning even a relatively small portion of a financially viable company to recover their initial investments in Cirracor. Acting on behalf of Panda, Grove Street formed a limited liability company, called Grove Panda, and purchased 2.73 million Cirracor common shares, or 78 percent of the company, for about $475,000.

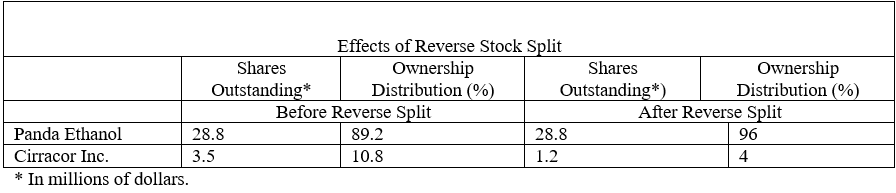

The merger proposal provided for one share of Cirracor common stock to be exchanged for each share of Panda Ethanol common outstanding stock and for Cirracor shareholders to own 4 percent of the newly issued and outstanding common stock of the surviving company. Panda Ethanol shareholders would own the remaining 96 percent. At the end of 2005, Panda had 13.8 million shares outstanding. On June 7, 2007, the merger agreement was amended to permit Panda Ethanol to issue 15 million new shares through a private placement to raise $90 million. This brought the total Panda shares outstanding to 28.8 million. Cirracor common shares outstanding at that time totaled 3.5 million. However, to achieve the agreed-on ownership distribution, the number of Cirracor shares outstanding had to be reduced. This would be accomplished by an approximate three-for-one reverse stock split immediately prior to the completion of the reverse merger (i.e., each Cirracor common share would be converted into 0.340885 shares of Cirracor common stock). As a consequence of the merger, the previous shareholders of Panda Ethanol were issued 28.8 million new shares of Cirracor common stock. The combined firm now has 30 million shares outstanding, with the Cirracor shareholders owning 1.2 million shares. The following table illustrates the effect of the reverse stock split.

A special Cirracor shareholders' meeting was required by Nevada law (i.e., the state in which Cirracor was incorporated) in view of the substantial number of new shares that were to be issued as a result of the merger. The proxy statement filed with the Securities and Exchange Commission and distributed to Cirracor shareholders indicated that Grove Panda, a 78 percent owner of Cirracor common stock, had already indicated that it would vote its shares for the merger and the reverse stock split. Since Cirracor's articles of incorporation required only a simple majority to approve such matters, it was evident to all that approval was imminent.

On November 7, 2007, Panda completed its merger with Cirracor Inc. As a result of the merger, all shares of Panda Ethanol common stock (other than Panda Ethanol shareholders who had executed their dissenters' rights under Delaware law) would cease to have any rights as a shareholder except the right to receive one share of Cirracor common stock per share of Panda Ethanol common. Panda Ethanol shareholders choosing to exercise their right to dissent would receive a cash payment for the fair value of their stock on the day immediately before closing. Cirracor shareholders had similar dissenting rights under Nevada law. While Cirracor is the surviving corporation, Panda is viewed for accounting purposes as the acquirer. Accordingly, the financial statements shown for the surviving corporation are those of Panda Ethanol.

-Why do you believe Panda did not directly approach Cirraco ? How were the Panda Grove investment holdings used to influence the outcome of the proposed merger?

Definitions:

Williams Act

A subset of the Securities Exchange Act of 1934, regulating tender offers and requiring disclosure of information by anyone seeking to acquire more than 5% of a company's securities.

Tender Offers

Public, open proposals by a party to purchase a substantial portion of a company’s shares or bonds from its shareholders or bondholders.

Consent Orders

Legal agreements approved by a judge that resolve disputes without admitting guilt or fault by either party, often used in regulatory settlements.

Merger Negotiations

The process of discussing and reaching an agreement on the terms of combining two or more companies into one entity.

Q2: In early 2008, a year marked by

Q3: If the market for diamonds is at

Q22: Distributors who are in a grocery store

Q60: Which of the following is not true

Q68: LBOs can be of an entire company

Q95: Why do you believe that Teva chose

Q99: Canada is home to a(n) _ economy.<br>mixed

Q110: John is experiencing _ unemployment because he

Q127: Don is unemployed because of a downturn

Q219: An economic system is<br>an agreement between countries