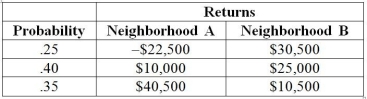

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if you can invest 10% of your money on the house in neighborhood A and the remaining on the house in neighborhood B, what is the portfolio risk of your investment?

Definitions:

NPV Profile

A graphical representation depicting the relationship between the Net Present Value (NPV) and various discount rates.

Slopes Downward

In economics, describes a line on a graph that decreases in value as it moves from left to right, indicating a negative relationship between two variables.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments by calculating the discount rate that makes the net present value of cash flows zero.

Mutually Exclusive

Situations or events that cannot occur at the same time.

Q27: Referring to Table 6-5, what is the

Q27: The smaller the spread of scores around

Q96: Referring to Table 8-10, it is possible

Q97: In general, which of the following descriptive

Q99: There are only 4 empty rooms available

Q125: The amount of time necessary for assembly

Q151: The probability that house sales will increase

Q165: Referring to Table 5-5, what is the

Q167: Referring to Table 7-6, among all the

Q179: Suppose Z has a standard normal distribution