TABLE 14-10

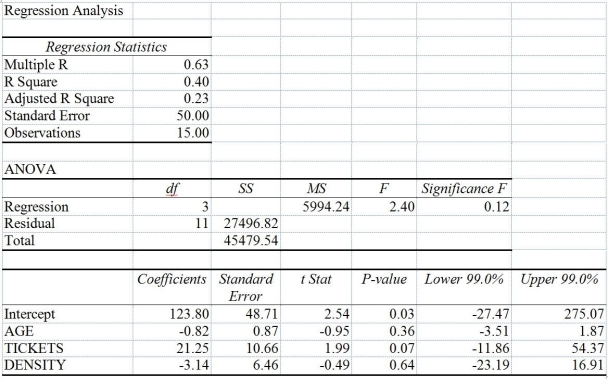

You worked as an intern at We Always Win Car Insurance Company last summer. You notice that individual car insurance premiums depend very much on the age of the individual, the number of traffic tickets received by the individual, and the population density of the city in which the individual lives. You performed a regression analysis in Excel and obtained the following information:

-Referring to Table 14-10, to test the significance of the multiple regression model, the null hypothesis should be rejected while allowing for 1% probability of committing a type I error.

Definitions:

Qualifications

The skills, experience, and education required to perform a job or task, or criteria to receive a benefit.

File

To file means to submit documents officially to a required authority, often used in the context of filing taxes or legal paperwork.

Head of Household

A filing status for tax purposes that provides higher standard deductions and lower tax rates for individuals who are unmarried and support dependents.

Taxable Income

The amount of income that is used to calculate an individual's or a company's income tax due. It is the gross income minus deductions and exemptions allowed by the tax code.

Q18: The sample correlation coefficient between X and

Q57: Referring to Table 16-7, the number of

Q67: Referring to Table 13-4, set up a

Q113: The interpretation of the slope is different

Q115: Referring to Table 16-13, in testing the

Q141: Referring to Table 16-6, use the Holt-Winters

Q171: Referring to Table 14-16, what are the

Q176: Referring to Table 16-14, what is the

Q181: Referring to Table 16-6, exponential smoothing with

Q190: The squared difference between the observed and