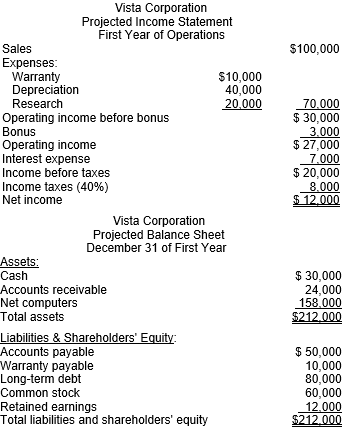

Vista Corporation, producer of computer software packages, began operations on January 1. It acquired financing from the issuance of common stock for $60,000,000 and long-term debt for $80,000,000. At the beginning of business operations, Vista produced the following projected income statement and balance sheet for the first year. All amounts are in thousands.

The new president is rather disappointed with these projected results having just quit a job of which his compensation package was $4,000,000. After examining the forecasts of a bonus of only $3,000,000, the president decides to use his knowledge of financial statements to modify his bonus. He meets with the company's CFO the next day to see what could be done. He suggested the following possibilities that would boost the first year's income:

1. Slash research and development expenditures, which are paid in cash, from $20 million to $10 million.

2. Double the estimated life of the computers, which will decrease depreciation expense from $40 million to $20 million. Because identical accounting procedures are used for taxes, no deferred taxes will be generated. Taxes require immediate payment.

3. Reduce estimated warranty expense from 10% of sales to 7% of sales.

4. Any resultant change in the bonus of 10% of operating income before the bonus will be paid to the president in cash.

A. Adjacent to the income statement for Year 1, create a new statement using the alternative accounting procedures and operating decisions.

B. Compare the president’s compensation if the changes in part A are enacted with his current compensation. What are the ramifications of these changes on the future?

Definitions:

Tires

Manufactured rubber products designed to cover wheels of vehicles to provide traction and absorb shock.

Tennessee Court Of Appeals

An intermediate appellate court in Tennessee that reviews decisions from lower courts.

Lease

A contractual agreement where one party, the lessor, grants the other party, the lessee, the right to use an asset for a specified period in exchange for payment.

Illusory Promise

A statement that appears to be a promise but, upon closer examination, offers no commitment or assurance to act.

Q8: On December 11, 2017, Bisbee Co. purchased

Q12: The recognition of unrealized gains on passive

Q13: Which of the following statements is true?<br>A)IFRS

Q18: Immediately before a 15% stock dividend was

Q36: What are post-acquisition expenditures? How are they

Q37: Explain how the presence or absence of

Q46: During the year, Caltech Inc.'s accounts receivable

Q55: The following information was taken from

Q64: Identify two different third-party collections and explain

Q68: Duncan Industries sold $100,000 of 12 percent