Suppose that a tire manufacturer uses  and R charts based on subgroups of size 4 to monitor tire diameter.The

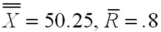

and R charts based on subgroups of size 4 to monitor tire diameter.The  andR charts are found to be in statistical control,with

andR charts are found to be in statistical control,with  inches.A histogram of the tire diameter measurements indicates that these measurements are approximately normally distributed.Find the sigma level capability of the process.

inches.A histogram of the tire diameter measurements indicates that these measurements are approximately normally distributed.Find the sigma level capability of the process.

Definitions:

Guaranteed Payments

Guaranteed Payments are payments made by a partnership to a partner for services or capital investment, which are not dependent on the partnership's income.

Separately Stated

Items on a tax return or financial statement that are listed individually to identify their specific impact on taxation or financial analysis.

Partnership Interest

An ownership share in a partnership that represents a partial right to its assets, income, and gains.

Outside Basis

Refers to a partner's or investor's tax basis in an individual partnership interest or investment, including the initial investment amount plus any additional contributions and adjusted by allocations of income or loss and distributions.

Q8: Which of the following accounts relied on

Q28: The _ assumption requires that all variation

Q33: Consider a set of 50 measurements with

Q63: If we are predicting y when the

Q63: In a simple linear regression model,the coefficient

Q69: A manufacturer of windows produces one type

Q72: Describe the three components of the statement

Q74: When computing confidence intervals using the Tukey

Q75: In one-way ANOVA,a large value of F

Q76: What financial statement communicates profits retained and