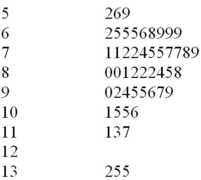

A CFO is looking at how much the company is spending on computing.He samples companies in the pharmaceutical industry and develops the following stem-and-leaf graph.  What would be the first class interval for the frequency histogram?

What would be the first class interval for the frequency histogram?

Definitions:

Credit Default Swaps

Financial derivative contracts that transfer the credit exposure of fixed income products between parties, used as a form of insurance against default on loans or bonds.

Interest Rate Risk

Interest rate risk is the potential for investment losses due to fluctuations in interest rates, affecting the value of fixed-income securities inversely.

Protection Sellers

Protection sellers in a financial context typically engage in credit derivatives markets, selling credit protection to hedge against the risk of default on underlying credit assets.

Protection Buyers

In derivatives trading, individuals or entities that purchase credit protection to hedge against potential losses from a credit event like default.

Q10: (A) What sample size would be required

Q27: Historical data for a local steel manufacturing

Q27: Suppose that A<sub>1</sub>,A<sub>2</sub>,and B are events where

Q48: The standard error of the sampling distribution

Q53: Researchers wish to study fuel consumption rates

Q62: Bayes' is useful in determining the value

Q76: The stem-and-leaf display is advantageous because it

Q108: The local amusement park was interested in

Q118: In a major midwestern university,55 percent of

Q132: The equation for the variance of the