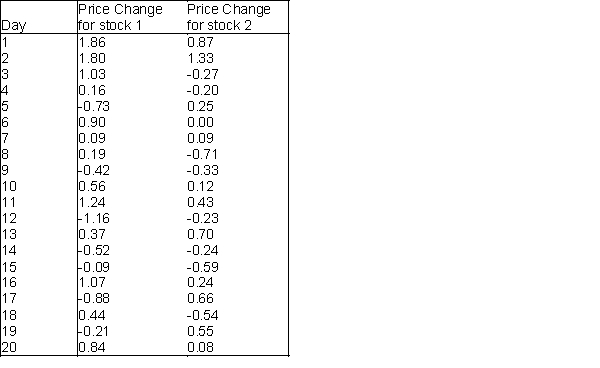

An investor wants to compare the risks associated with two different stocks. One way to measure the risk of a given stock is to measure the variation in the stock's daily price changes. The investor obtains a random sample of 20 daily price changes for stock 1 and 20 daily price changes for stock 2. These data are shown in the table below. Show how this investor can compare the risks associated with the two stocks by testing the null hypothesis that the variances of the stocks are equal. Use  = 0.10 and interpret the results of the statistical test.

= 0.10 and interpret the results of the statistical test.

Definitions:

Characteristic Stretch

Specific vibrational movements in molecules observed in infrared spectroscopy that help identify functional groups.

Mass Spectrometer

An analytical instrument used to identify substances within a sample by sorting gaseous ions based on their mass-to-charge ratios.

IR Absorptions

Specific wavelengths of infrared light absorbed by molecules, indicative of various functional groups and molecular structures in infrared spectroscopy.

M/Z Value

Mass-to-charge ratio, a key concept in mass spectrometry used to identify molecules by their mass and charge.

Q6: The set of all possible outcomes for

Q11: A probability sample is a sample in

Q25: Suppose that A<sub>1</sub>,A<sub>2</sub>,and B are events where

Q34: A low p-value provides evidence for accepting

Q35: In a hearing test,subjects estimate the loudness

Q51: A report on high school graduation stated

Q59: If a population distribution is skewed to

Q66: The approximate 95% confidence interval for a

Q85: A teacher who is trying to prove

Q103: Find the mean and standard deviation of