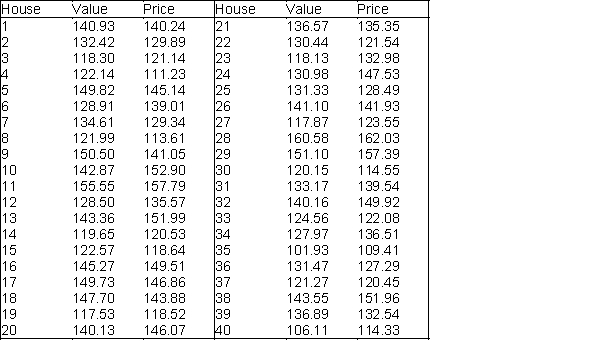

A real estate agent has collected a random sample of 40 houses that were recently sold in Grand Rapids, Michigan. She is interested in comparing the appraised value and recent selling price (in thousands of dollars) of the houses in this particular market. The values of these two variables for each of the 40 randomly selected houses are shown below.

-(A) Use the sample data to generate a 95% confidence interval for the mean difference between the appraised values and selling prices of the houses sold in Grand Rapids.

(B) Interpret the constructed confidence interval fin (A) for the real estate agent.

Definitions:

Available-For-Sale

A classification for securities that are not held to maturity or for trading purposes, with unrealized gains or losses reported in equity.

Carrying Value

The stated value of an asset on a company's balance sheet, minus accumulated depreciation or amortization.

Available-For-Sale

A classification for financial assets indicating they are not primarily held for trading purposes or expected to be sold in the short-term, allowing for changes in value to be recorded in other comprehensive income.

Amortized Cost

The initial investment amount of a financial asset or liability adjusted for principal repayments and, if applicable, the cumulative effect of using the effective interest method.

Q4: The company financial officer was interested in

Q14: The local amusement park was interested in

Q22: The weight of a chemical compound used

Q30: A 90% confidence interval estimate for a

Q44: The opportunity for sampling error is decreased

Q49: If A and B are any two

Q77: A Type II error is committed when

Q108: What is the probability that a randomly

Q108: The local amusement park was interested in

Q109: The variance of a binomial distribution is