Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

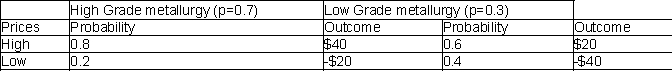

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

-Since the core test can only sample a small part of the mine, Southport's geologists believe it is somewhat unrealistic to view it as a perfectly reliable test. Based on similar tests they have conducted in the past, they believe that if the metallurgical properties of the ore are actually High Grade, then the probability that this test will return "favorable" results is 0.95. If the metallurgical properties are Low Grade, the probability that this test will return "favorable" results is only 0.25. Otherwise, the test results will be considered "unfavorable". Given this information, what are the posterior probabilities that the ore will be a High Grade and Low Grade, given the core test report?

Definitions:

Equity Method

A method of accounting employed by companies to evaluate the earnings from their investments in other firms.

Subsidiary

A company controlled by another company, often referred to as the parent company.

Fair Value

The likely receipts from offloading an asset or the expenditure to relocate a liability, in a systematic transaction at the market rate on the day of valuation.

Q7: In systematic sampling, one of the first

Q20: What number of cars, equidistant from the

Q26: Find the probability that one customer is

Q32: The general term for a graphical display

Q35: The form of the alternative hypothesis can

Q60: If two events are collectively exhaustive, what

Q61: What is the probability that it will

Q63: A CFO is looking at how much

Q82: An example of manipulating a graphical display

Q86: The mode is best described as the:<br>A)