An executive has been offered a compensation package that includes stock options. The current stock price is $30/share, and she has been offered a call option on 2000 shares, which can be exercised five years from now at a price of $42/share. Therefore, if the market price of the shares in five years is more than $42/share, she can buy 2000 shares at $42/share, and then immediately sell the shares at the market price, earning a riskless profit. If the market price of the shares was less than $42/share, she will obviously choose not to exercise the option, and would have zero profit.

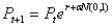

Assume the price of the stock can be modeled as exponential growth (compounding), which could be calculated as:  where,

where,  stock price in next period (i.e., price next year)

stock price in next period (i.e., price next year)  current stock price

current stock price  annual growth rate of the stock price, which has been 10%

annual growth rate of the stock price, which has been 10%  annual volatility, which is estimated to be 18%

annual volatility, which is estimated to be 18%  normal random variable with mean of zero and standard deviation of 1

normal random variable with mean of zero and standard deviation of 1

-Simulate the price of the stock in five years by calculating five annual increments (steps) with this model, starting from the current price of $30/share. For each price simulated five years from now, model the exercise decision and calculate the resulting profit, which should then be discounted for five years at the current discount rate (5%) to obtain the present value of the options. What is the expected value of the stock options?

Definitions:

Current Assets

Assets of a business that are expected to be converted into cash, sold, or consumed within one year or within the business's operating cycle, whichever is longer.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered but not yet paid for.

Financial Management

The practice of planning, organizing, directing, and controlling the financial activities such as procurement and utilization of funds of an enterprise.

Company's Funds

The assets or money that a company possesses for the purpose of conducting its business activities.

Q4: Jeremiah is testing the impact of different

Q16: Approximate the percentage of these Internet users

Q30: Data has been collected on store size

Q33: Which of the following statements are false

Q39: Approximate the percentage of these internet users

Q50: Obtain another set random numbers by pressing

Q57: Perform a simulation assuming the plant will

Q63: An auto company must meet (on time)

Q87: A frequency table indicates how many observations

Q110: How many of the wells can the