An executive has been offered a compensation package that includes stock options. The current stock price is $30/share, and she has been offered a call option on 2000 shares, which can be exercised five years from now at a price of $42/share. Therefore, if the market price of the shares in five years is more than $42/share, she can buy 2000 shares at $42/share, and then immediately sell the shares at the market price, earning a riskless profit. If the market price of the shares was less than $42/share, she will obviously choose not to exercise the option, and would have zero profit.

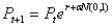

Assume the price of the stock can be modeled as exponential growth (compounding), which could be calculated as:  where,

where,  stock price in next period (i.e., price next year)

stock price in next period (i.e., price next year)  current stock price

current stock price  annual growth rate of the stock price, which has been 10%

annual growth rate of the stock price, which has been 10%  annual volatility, which is estimated to be 18%

annual volatility, which is estimated to be 18%  normal random variable with mean of zero and standard deviation of 1

normal random variable with mean of zero and standard deviation of 1

-Simulate the price of the stock in five years by calculating five annual increments (steps) with this model, starting from the current price of $30/share. For each price simulated five years from now, model the exercise decision and calculate the resulting profit, which should then be discounted for five years at the current discount rate (5%) to obtain the present value of the options. What is the expected value of the stock options?

Definitions:

MC

Marginal Cost, the increase in total cost that arises from an extra unit of production.

MR

Marginal Revenue, the additional income generated from selling one more unit of a product or service.

Perfectly Elastic

Perfectly elastic refers to a situation where the quantity demanded or supplied responds infinitely to changes in price.

Perfectly Inelastic

A situation in which the quantity demanded or supplied of a good does not change in response to a change in price.

Q2: What is one assumption of two-way ANOVA

Q5: Morgan has calculated the upper and lower

Q15: Probability is a number between 0 and

Q20: In transportation problem, shipping costs are often

Q33: Suppose that a customer satisfaction firm approaches

Q36: In a typical minimum cost network flow

Q45: Phone numbers, Social Security numbers, and zip

Q59: What is probability of observing the sale

Q97: In nonlinear models, which of the following

Q99: In order for the characteristics of a