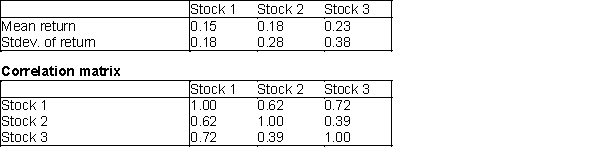

Assume that you are given the following means, standard deviations, and correlations for the annual return on three stocks.  The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

Definitions:

Q32: Simulation models are particularly useful for:<br>A) forecasting<br>B)

Q34: A manufacturer can sell product 1 at

Q43: Because they represent such extreme values, outliers

Q52: Use the method of moving average with

Q63: Where will you find "time" on a

Q67: A scatterplot that exhibits a "fan" shape

Q76: The time series component that reflects a

Q77: Develop an @RISK model to estimate the

Q97: (A) Verify that Mary should purchase 12

Q105: In aggregate planning models, the number of