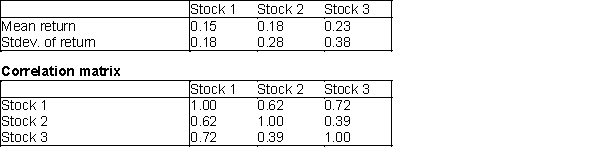

Assume that you are given the following means, standard deviations, and correlations for the annual return on three stocks.  The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

Definitions:

Monetary Rule

The money supply may grow at a specified annual percentage rate, generally about 3–4 percent.

Money Supply

The total quantity of money available in the economy at a specific time, including cash, coins, and balances held in checking and savings accounts.

Recessionary Gap

This occurs when equilibrium GDP is less than full-employment GDP.

Aggregate Demand

The total demand for all goods and services within an economy at a given overall price level and in a given time period.

Q14: The deterministic (non-simulation) approach, using best guesses

Q18: A correlation matrix must always have 1's

Q21: What are the decision variables in this

Q24: Which of the following statements are false?<br>A)

Q46: A histogram that is positively skewed is

Q64: Suppose this new drug will cost $3

Q70: Suppose we have a 0-1 output for

Q75: Many of the most successful applications of

Q85: A trend component of a time series

Q98: Any integer programming problem involving 0-1 variables