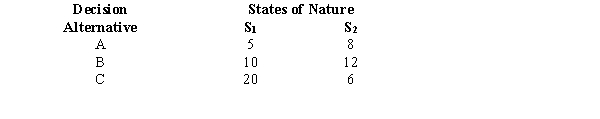

Exhibit 21-1

Below you are given a payoff table involving two states of nature and three decision alternatives.  The probability of occurrence of S1 = 0.2.

The probability of occurrence of S1 = 0.2.

-Refer to Exhibit 21-1. The expected monetary value of the best alternative is

Definitions:

Fama and French

Economist researchers known for their development of a three-factor model to explain stock returns based on market risk, size, and book-to-market value factors.

Firm Size

A measure of a company's size, often determined by its market capitalization, number of employees, or total assets.

Explanatory Power

The ability of a statistical model to account for a variation in a dependent variable through one or more independent variables.

Benchmark Error

A discrepancy between the performance of a benchmark index and the target performance of a fund or investment strategy it is supposed to represent.

Q1: Refer to Exhibit 21-2. The expected value

Q6: Refer to Exhibit 19-3. The p-value for

Q10: The prices of an item for the

Q18: The time series component that reflects variability

Q19: The quarterly sales of a company (in

Q33: The Paasche index is a weighted aggregate

Q41: Consider the following data on personal savings

Q41: The following model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2206/.jpg" alt="The following

Q63: Simple random sampling has been used to

Q79: The coefficient of determination<br>A)cannot be negative<br>B)is the