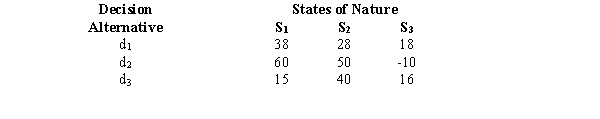

Suppose we are interested in investing in one of three investment opportunities: d1, d2, or d3. The following profit payoff table shows the profits (in thousands of dollars) under each of the 3 possible economic conditions-S1, S2, and S3.  Assume the states of nature have the following probabilities of occurrence.P(S1) = 0.2

Assume the states of nature have the following probabilities of occurrence.P(S1) = 0.2

P(S2) = 0.3

P(S3) = 0.5

a.Determine the expected value of each alternative and indicate which decision alternative is the best.

b.Determine the expected value with perfect information about the states of nature.

c.Determine the expected value of perfect information.

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, representing how much of the asset's value has been used up during the period.

Net Capital Spending

The total expenditure on fixed assets less any sales of fixed assets.

Capital Gains

The profit from the sale of a property or an investment when the selling price exceeds the purchase price.

Marginal Tax Rates

The rate at which the last dollar of income is taxed, reflecting the portion of an incremental income that is paid in taxes.

Q1: Which of the following is(are) the most

Q22: We are interested in determining what

Q32: Actual sales of a company (in millions

Q36: The sales volumes of CMM, Inc., a

Q53: Consider the following data. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2206/.jpg" alt="Consider

Q64: Refer to Exhibit 16-2. The p-value for

Q64: The following time series shows the

Q69: The labeling of parts as "defective" or

Q75: Refer to Exhibit 16-4. The degrees of

Q80: Refer to Exhibit 15-3. The coefficient of