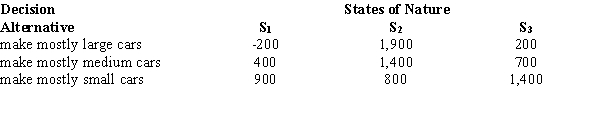

An automobile manufacturer must make an immediate decision on the car size that should account for the majority of the firm's production two years from now. The firm perceives three possible states of nature at that time: S1, gasoline will be rationed; S2, gasoline will be readily available at close to current prices; and S3, gasoline will be readily available, but at much higher prices. The firm has determined the following profit payoff table (in $1,000s).

a.An economist at the auto company has advised the firm that the probabilities of the states of nature are P(S1) = .2, P(S2) = .5, and P(S3) = .3. Find the expected monetary value for the three decisions.

b.Which decision should be chosen under the expected monetary value criterion?

c.Determine the expected value of perfect information.

Definitions:

Return On Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated as net profit divided by the cost of the investment.

Operating Assets

Assets that are used for the day-to-day operations of a business, including cash, inventory, and property, plant, and equipment.

Minimum Required Rate

The lowest acceptable rate of return on an investment demanded by an investor, considering risk factors.

Net Operating Income

The profit generated from a company's everyday operations, excluding income from investments and extraordinary items.

Q2: Information about a state of nature is

Q2: Below you are given information on crime

Q15: Normal or natural variations in process outputs

Q21: A target population is<br>A)the population from which

Q25: Refer to Exhibit 16-1. The coefficient of

Q27: The following regression model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2206/.jpg" alt="The

Q29: A monthly price index that uses the

Q46: Refer to Exhibit 16-2. The test statistic

Q61: Refer to Exhibit 16-1. The test statistic

Q111: The interval estimate of the mean value