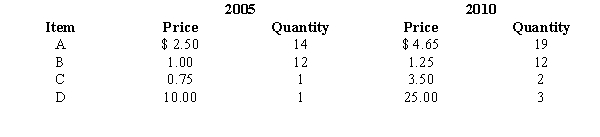

Consider the following information regarding items A, B, C, and D.

a.Compute the price relative index for 2010 using 2005 as the base year.

b.Compute the unweighted aggregate price index.

c.Compute the Laspeyres index.

d.Compute the Paasche index.

e.Construct a weighted aggregate quantity index using 2005 as the base year and price as the weight.

Definitions:

NSF Check

A check that has been returned without being honored due to insufficient funds in the account it was drawn against.

Petty Cash Fund

A small amount of cash kept on hand for making immediate payments for miscellaneous, small expenses instead of writing checks.

Replenish

To fill up or restore to a previous level, often used in the context of inventory or supplies.

Internal Control

A process designed to ensure the safety and efficiency of the financial operations of a company, along with compliance with laws and accuracy in reporting.

Q3: The following results were obtained from a

Q4: Consider the following time series. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2206/.jpg"

Q27: The following regression model has been proposed

Q30: The target population and the sampled population<br>A)are

Q36: The correlation in error terms that arises

Q40: Refer to Exhibit 14-10. The slope of

Q55: Refer to Exhibit 16-4. The multiple coefficient

Q58: From a population of 2000 accounts receivable,

Q84: Refer to Exhibit 15-5. The t value

Q94: Larger values of r<sup>2</sup> imply that the