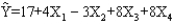

Exhibit 15-3

In a regression model involving 30 observations, the following estimated regression equation was obtained:  For this model SSR = 700 and SSE = 100.

For this model SSR = 700 and SSE = 100.

-Refer to Exhibit 15-3. The conclusion is that the

Definitions:

Digital Option

A financial instrument that provides a fixed return if the market price is above (for a call) or below (for a put) a certain level at expiration.

Bull Money Spread

A type of options strategy that is used when an investor expects a moderate rise in the price of the underlying asset.

Calls

Calls are options contracts giving the holder the right, but not the obligation, to buy a specified amount of an underlying security at a predetermined price within a specified time frame.

Option Quotes

Information about the price of an option contract, including its bid and ask prices, and sometimes the volume and open interest.

Q7: In the linear trend equation, T =

Q9: In simple linear regression analysis, which of

Q10: Refer to Exhibit 13-6. If at 95%

Q28: Refer to Exhibit 19-3. The null hypothesis

Q30: Refer to Exhibit 13-7. The computed test

Q38: A sample of 22 bottles of soft

Q52: Refer to Exhibit 12-6. The p-value is<br>A)greater

Q57: Assume you are faced with the following

Q62: A sample of 4 clusters is to

Q67: If the coefficient of correlation is 0.4,