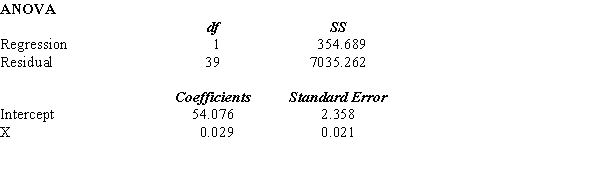

Shown below is a portion of a computer output for a regression analysis relating supply (Y in thousands of units) and unit price (X in thousands of dollars).

a. What has been the sample size for this problem?

b. Perform a t test and determine whether or not supply and unit price are related. Let = 0.05.

c. Perform and F test and determine whether or not supply and unit price are related. Let = 0.05.

d. Compute the coefficient of determination and fully interpret its meaning. Be very specific.e. Compute the coefficient of correlation and explain the relationship between supply and unit price.f. Predict the supply (in units) when the unit price is $50,000.

Definitions:

State Unemployment Taxes

Taxes paid by employers to fund the state's unemployment insurance program, providing financial assistance to workers who have lost their jobs.

Employee Payroll Deductions

Amounts withheld from an employee's salary for taxes, insurance, and other mandatory or voluntary contributions.

Federal Unemployment Taxes

Taxes paid by employers to the federal government to fund unemployment benefits and job service programs.

Insurance Pension Plans

Retirement plans that combine the benefits of insurance and savings, providing income after retirement through periodic premiums paid during a worker’s employment.

Q10: In acceptance sampling, the risk of rejecting

Q23: Two hundred fifty managers with degrees in

Q38: Refer to Exhibit 12-7. The p-value is<br>A)greater

Q54: In order to estimate the difference between

Q62: In order to test for the significance

Q71: A sample of 25 families was

Q84: Refer to Exhibit 15-5. The t value

Q91: If the probability of a Type

Q110: If the coefficient of determination is equal

Q111: The interval estimate of the mean value